Best Places for You to Buy Bitcoin in 2024

Bitcoin has been and continues to rule the crypto roost, and there are various platforms that traders can access to purchase bitcoin. For you to purchase and sell bitcoin there is a need for a wise selection of a prominent and reputable exchange. Exchange platforms are diverse and offer various services. These include the exchange of bitcoin with fiat, exchanging BTC for other digital currency, and more. At the best places to buy bitcoin, you can expect the following:

- fast creation of accounts

- flexible account usage

- cost-effectiveness

- various payment methods, and more.

These platforms are not selective; they are for everyone, be they crypto savvy or crypto beginners. So, when thinking of the best and easiest way to buy bitcoin, make a clear assessment of what they offer. Luckily, bitcoin can be purchased with cash, and exchange platforms now have the best websites. Read more below on how you can get started.

Table of Contents

Quick Step-By-Step Guide on How to Buy Bitcoin on CEX.IO

CEX.IO is the ultimate platform with a plethora of payment options. Traders and users can actually select from modes of payment available to buy bitcoin. One special example is derived from Instant Buy Service which allows the purchase of bitcoin quickly. Instant Buy allows the use of a card. You can also use CEX.IO balance, a perfect way to purchase bitcoin in a matter of seconds. lt is reliable and fast when executing purchases. Before we have listed steps that should be followed to purchase bitcoin on CEX.IO.

- Firstly, opt for the purchase/selling page on the website. You can also use the mobile application.

- Choose bitcoin the exact amount of bitcoin you want to use and the amount of fiat you wish to receive.

- Select a pre-calculated set and insert your amount of choice.

- Choose a payment method.

- Verify your transactions and confirm.

Where can you buy Bitcoin?

There are many places that one can reach out if they want to purchase bitcoin. It is actually a host of hundreds of bitcoin purchasing sites, but before we move any further, we have to indicate 3 basic bitcoin purchasing categories.

Exchanges

Cryptocurrency exchange sites have been shaping up the crypto business for a long time. They basically offer purchases, sales, and storage of many altcoins including bitcoin. Some of the prominent exchange sites include Coinbase and Gemini.

Brokerages

Next to exchanges we have placed brokerages that grant traders and users an opportunity to purchase bonds, mutual funds, or even stocks. You can sell various cryptocurrencies in an attempt to fulfill an investment. One of the best examples around is Robinhood. It is that ultimate brokerage that continues to attract many traders across the world.

Apps

The above categories all have official applications but looking at this category, it is an official application that has cryptocurrency exchanges. They also contain brokerages that act as middlemen between the buyer and seller of bitcoin. If you are looking for the best Apps, check out Venmo and Cash App. These two are important to the crypto industry.

Where to buy Bitcoin?

Coinbase

Who doesn’t know Coinbase! It is the ultimate cryptocurrency provider platform which has a huge wallets system. Coinbase is headquartered in San Fransisco. Has over 56 million registered users who are dotted in 100 countries. For all those crypto fanatics, Coinbase is that spectacular cryptocurrency site perfect for bitcoin purchases.

At the moment, it has $335 billion worth of digital assets. This figure was derived from the trading volume of the last assessed quarter. Expect a low fee charge, very conducive for low bidders or beginners. As part of the fee, there is Fiat per transaction standing at 0.50%. But the most important aspect in fee charge, it depends on which payment method you used.

If you use a debit card, you are charged 3.99% per transaction. Thanks to crypto designers that have upgraded their Coinbase platform to a pro version. It is more ideal and offers an automated pricing model. As usual, Coinbase is guarded by a 2FA authentication system which proves to be very beneficial. You can store many crypto assets.

Pros

- Coinbase has 56 million customers across the world. They are registered and officially operating on Coinbase enabling a lot of guarantees.

- Fee charges are very low and it’s a blessing to beginners.

- Has a plethora of cryptocurrency selections and it’s actually a blessing to many traders.

Cons

- Traders can encounter high fees during spread pricing.

- Debit cards charge 3.99% which is hefty.

CEX.IO

As we mentioned earlier, CEX.IO is the ultimate UK-based exchange. It has a wide range of payment methods based on credit and debit cards. CEX.IO transactions take a long time. It is very reputable and has a huge customer base. All you have to do is to offer all your personal details for account verification.

Pros

- Payments are made fast through credit cards.

- Has a wide range of reputable payment methods giving freedom of choice.

- Security is uptight because CEX.IO is guarded by a 2FA system.

Cons

- Submission of personal details might create loopholes.

- Credits are fast but hefty in terms of charges.

- It takes too long for account confirmation.

Coinmama

Coinmama has quick authentication systems that of accounts and wallets. You don’t have to wait for hours to have your account creation verified. It takes a simple log-in to start purchasing bitcoin. Coinmama has various payment methods which include debit/credit cards and bank payments. Purchases are fast and confirmation is fast also.

There is access to various currencies depending on which country you come from. In the UK, euros are mostly accessible. Coinmama allows traders to place orders. After the placement of orders, they have to select the exact amount they want to be deposited into the wallet. However, funding and depositing of bitcoin can not be done in USD. The USA has been barred from participation in the USA.

Though such has been the case, the introduction of ACH payments is actually the way to go. They (ACH Payments) will be USA-based and all transfers will be done electronically in the US. Coinmama is very versatile because traders can purchase coins using any wallet available. We recommend that you use Coinmama because it upholds fast purchases and payout choices are many. Let us look at the advantages and disadvantages.

Pros

- As mentioned earlier, Coinmama is very fast when placing orders.

- Crypto transfer is versatile and very reliable.

- Funding or depositing selections are many.

Cons

- Coinmama has a daunting user interface for beginners.

- Though transactions are fast, a 5% top-up fee is added.

- Does not support ACH transfer systems, a big letdown to customers in the USA.

LocalBitcoins

It is a unique site that has some fantastic features. Enables peer-to-peer exchange. Expect exciting adverts that showcase various payment methods and rates. It’s that perfect bitcoin purchasing site that everyone has been envying. You can activate a buyer and seller protection system and this protection is part of the adverts that are displayed on the official page. LocalBitcoins has free registration and it’s actually free to execute transactions. Only expect a 1% fee charged for a successful trade.

Pros

- Has many payment options

- Localbitcoins charge nothing for registration.

Cons

- It’s quite an underdog and has not yet gathered experience.

Gemini

Gemini is located and headquartered in the USA making it the ultimate platform for USA traders. You can purchase huge amounts of Bitcoin while interacting with some modern and unique additions to the whole interface. Gemini has an exchange review meaning that traders are able to weigh which transaction rates and which payment methods to use. The review also contains hard-hitting pros and cons. Traders and many investors are able to get enough skills of how trading should be lucrative to you. Let us look at the advantages and disadvantages of Gemini.

Pros

- Crypto choices are many; it’s not only focused on bitcoin.

- Purchasing limit is very considerable.

- Gemini mobile application is compatible.

- Gemini is all modern. It is an advanced piece of the trading platform.

- Traders can actually earn good interest.

- The review is top-notch in equipping traders and investors with enough entail.

Cons

- It’s not all the prominent cryptocurrencies available on Gemini.

- Gemini does not support debit card payment methods.

- When it comes to miniature trades, fee charges are hefty.

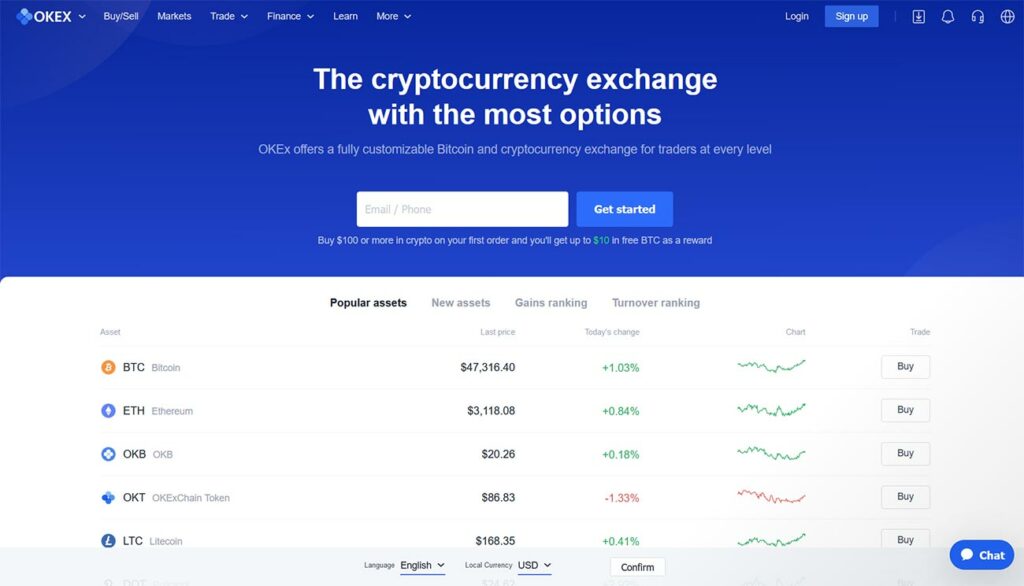

OKEx

It is a worldwide crypto site that allows traders and investors to access bitcoin services and other digital financial services through a blockchain setup. It is the future of perfect pairing meaning that traders can get lucrative token pairings in the process optimizing traders’ chances of getting maximum payouts. OKEx is updating its site periodically and targets those cryptos that are prominent on the market OKEx is very convenient and largely appropriate for tech-savvy traders.

It is a worldwide crypto site that allows traders and investors to access bitcoin services and other digital financial services through a blockchain setup. It is the future of perfect pairing meaning that traders can get lucrative token pairings in the process optimizing traders’ chances of getting maximum payouts. OKEx is updating its site periodically and targets those cryptos that are prominent on the market OKEx is very convenient and largely appropriate for tech-savvy traders.

Check out cryptos like Ripple, Litecoin, and Ethereum, assessing how they can be combined with bitcoin to form the best rates around. It does not end there, traders can actually purchase crypto in a whisker and can exchange the bitcoin to Fiat a quickly as possible.

Pros

- OKEx is very modern and fast

- Offers a wide variety of cryptos while encompassing prominent and lucrative coins.

- Is the ideal site for bulky purchase of bitcoin.

Cons

- The interface is a bit daunting for beginners

- Selective since the interface is perfect for crypto-savvy investors.

Bitpanda

Bitpanda is known for its wide range of payment methods. Investors have the privilege to select a perfect payment method when transacting. It is a European site which has many of its customers from Europe. Bitpanda charges 1.49% for purchasing and selling. The level of security is standard. All you have to do is provide your personal details, to create and verify a Bitpanda account. You can use your ID to purchase bitcoin with a credit card. It’s not only credit cards on offer but there are also other methods.

Pros

- It has a wide selection of payment methods

- Security and privacy are top-notch

Cons

- The fee charged is not that fair to miniature investors.

Robinhood

When it comes to that perfect site that is commission-free, Robinhood is there to cater for that. It’s friendly and has a perfect user interface that enables good crypto investing. Robinhood Crypto is there in the thick and thin of crypto. Backs up cryptocurrencies and this can be a benefit to many buyers.

Pros

- Has no commission when selling and buying cryptos.

- The user interface is very intuitive and friendly.

Cons

- Cryptocurrencies are very few as compared to other sites.

- Wallets options are also very few.

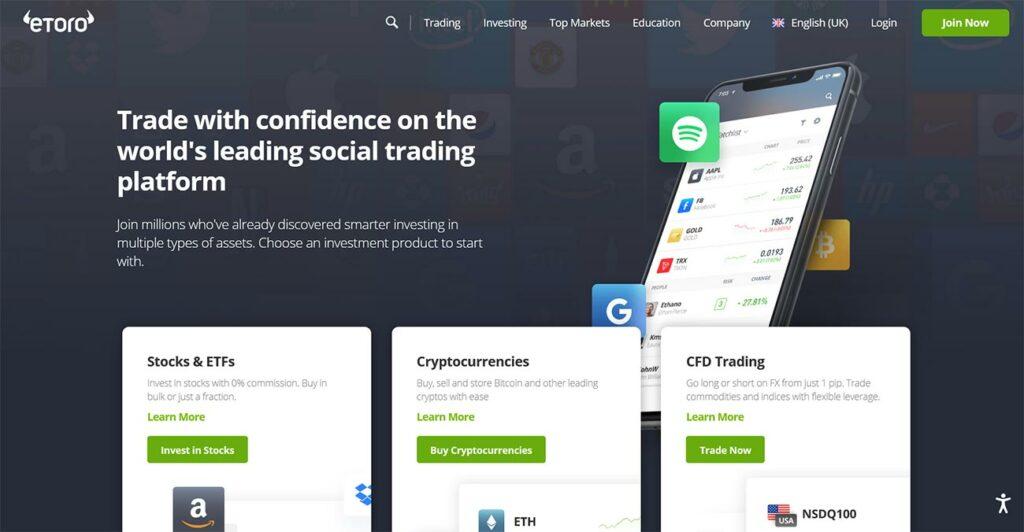

eToro

eToro is a very simple user as compared to most of the sites making a mark on the scene. It’s the perfect bitcoin purchasing platform for beginners and newcomers because it’s not that daunting as compared to other sites like Gemini. CopyTrader is used to guarantee trade imitation from other flourishing platforms.

eToro is a very simple user as compared to most of the sites making a mark on the scene. It’s the perfect bitcoin purchasing platform for beginners and newcomers because it’s not that daunting as compared to other sites like Gemini. CopyTrader is used to guarantee trade imitation from other flourishing platforms.

By investing $100,000 in your account, investors will enjoy a good take-off of depositing. Remember, 0.75% is derived from a spread price for each and every bitcoin purchase while other currencies charge more than that. Everything is easy and simple from eToro.

Pros

- A simple and direct bitcoin purchasing site.

- There are demo-like offers that can give you an experience of the real deal.

- You can learn something from CopyTrade.

Cons

- The fee charged on the spread price is hefty.

Huobi

Huobi was established in 2013. Since then, it has been offering financial services to Asian customers. It is only now that it broadened its reach to a worldwide audience. As it broadened its reach, it also went a massive upgrade. You can trade cryptos perfectly without any worry while oozing yourself through the new features.

Huobi supports a wide range of altcoins and new fresh cryptos like HUSD. Mind you, these are backed up by USD. Check out HT which propounds the best utility on the market. Technology is advanced while the interface maintains its general simple and direct options. You can expect price feeds, market depth, market profiling, and price feeds. Let us look at the advantages and disadvantages.

Pros

- Huobi is guaranteed.

- Has standard security and protection of crypto assets.

Cons

- Huobi is more appropriate for seasoned investors.

Binance

Binance is the ultimate site. Available for European customers and is currently the world’s best exchange. Tracking fee charges stand at 0.1% while investors can engage in free deposits. Withdrawal fees are also charged but vary when you use different payment methods.

Pros

- It is very reputable and guaranteed.

- Binance is licensed and legit.

- Security is catered for by the 2FA authentication system.

- Has many crypto choices.

Cons

- The system is now too large and can affect new investors.

Bitcoin ATM

Bitcoin ATM is best known for anonymity and absolute security. It is a kiosk of bitcoin purchasing. You can use a credit card and a debit card to change bitcoin for cash. Bitcoin purchasing can use KYC processes. You can store your bitcoin and you can actually manage your funds. For purchasing bitcoin, you are charge 7-10% interest.

Pros

- The fee charged at ATM’s is high for beginners

- It is fast and reliable.

- Security is uptight

Cons

- It’s narrow in terms of cryptocurrencies

What to look for when buying Bitcoin

There are many factors that investors have to look at when attempting Bitcoin purchase. It is not all about falling for the drill but it’s actually about that assessment before the drill.

Fees

Fees depend on which platform you have used and which payment you have used. For example, bank payments charge more fees than credit cards. It’s always important to look at how much is charged for a transaction.

Liquidity

Different exchanges have different liquidity. Binance has different liquidity from Huobi. This is the culture of exchanges and it continues to be the drill. Liquidity actually entails how much Bitcoin the exchange can put on the market before the price tag has been compromised. The best way to get the best liquidity is by checking out companies’ trading volume. Huge volumes entail large liquidity while and vice versa.

Speed

When purchasing bitcoin, some sites take a long time before the transaction is confirmed. Exchange alike Gemini and Binance are fast. There are some modest exchanges that are very slow, some even taking hours.

Accessibility

Many exchanges are now delving into mobile applications. Exchanges are compatible with laptops, desktops, and mobile devices. Smartphones are ruling the digital world and designers have made it possible to purchase in the comfort of your home. Using your device is actually a comfortable way of purchasing Bitcoin and making more financial decisions.

Investment selection

Investment selection is tricky if you make hurried choices. Make sure that you scrutinize the available investment opportunities. Investing in cryptocurrencies is best is made on reputable sites.

Educational resources

Some exchanges have been packaged with media content that is there to give investors crypto knowledge. Check out videos, articles, reviews, tutorials, and demos. These are all meant to equip investors with the right knowledge.

Bonuses

Most of the prominent exchanges grant lucrative bonuses. These are all meant to inspire and motivate investors’ funding. It’s actually a tiebreaker because exchanges usually have to battle out indirectly to get a wide customer base. Bonuses are always good and investors should always go for those lucrative sites with mouthwatering bonuses.

User-friendliness

Many bitcoin purchasing sites are now upgraded and modern. This means that bitcoin purchasing can be very easy while at some sites it can be very difficult. User interfaces of various exchanges are user-friendly but some have an extended edge of advancement. They are very selective and are not appropriate for beginners.

Privacy and security tips

In as much as we want to instill privacy details, we have to indicate from the get-go that these following issues are very important and should not be ignored. We list the factors below.

- Always make sure that you keep a fair amount of bitcoin in a hot wallet. Hot wallets are digital storage bags that are linked with the internet. Hot wallets cater for liquidity when it comes to cashing out BTC or depositing.

- Cold wallets are used when an investor needs to keep a lot of bitcoin. They are not linked to the internet and are more private. Even though cold wallets have a good reputation for security, hot wallets also have an edge for guaranteeing against theft.

- We mentioned brokerages and how they operate and it is key that all their cash balances be kept in a bank. Many applications controlled by many exchanges are safe. They are authorized and have been guarded by a set of vital security movements.

- Verification processes are reliable and efficient while investors enjoy maximum protection of funds. In every transaction or creation of a crypto wallet, verify your password and make sure that your 2FA authentication process is activated.

F.A.Q

What is a Bitcoin Exchange?

This is a crypto-based digital meeting place for sellers and buyers of bitcoin, the largest crypto in the world. Exchanges are compatible with many cryptos from Ethereum to Ripple. These marketplaces are actually huge and cover a huge spectrum. However, they have to be categorized into decentralized and centralized categories. Decentralized exchanges offer reasonable privacy while centralized offer fair privacy. It all depends on which exchange you are using.

How Does a Bitcoin Exchange Work?

Bitcoin exchanges act as middlemen between the buyer and the seller. This means that transaction, lucrative bitcoin pairing with fiat and crypto to crypto transactions can be sourced by Bitcoin Exchange. Blockchain can keep records and archive transactions. In other aspects, exchanges are there to perform transactions for investors.

Are Bitcoin Exchanges Legal?

They are by popular consensus regarded as legal in the USA. However, investors have the task of reporting capital gains so that your reputation is not tainted. Make sure that your tax filing is uptight and that transactions move in line with the policies available.

What Are Some Differences Between Bitcoin Exchanges and Wallets?

Wallets are there to keep your bitcoin and they are part and parcel of bitcoin exchanges but when it comes to bitcoin exchanges, these are basically sites of engagement between the buyer and seller. You can execute an exchange on a mobile application. Wallets vary from hot to cold and these are called external wallets. They operate outside the exchange.

What Are Some Differences Between Bitcoin Exchanges and Mining Software?

Mining software is linked with blockchain in the sense that they manage and level up bitcoin. Miners act as gallery holders, they keep a record of all the transactions that were executed in past. Exchanges are sites where the actual transactions take place.

Is Buying Bitcoin Safe?

It’s always good and wise to purchase bitcoin on a reliable site. This makes the whole process safe from the get-go. Reputable sites or exchanges have seen it all and their pricing rates are stable. This helps bulky or high bidders to always consider good exchanges. When you follow that path, you will truly see that buying bitcoin is safe.

Conclusion

Remember, fees, bonuses, security, and privacy are key factors when selecting the right exchange. These shape up your final payout and reward. There are, as mentioned in the article expensive and cheapest ways of purchasing bitcoin. There are many exchanges out there, from Binance to Coinbase but make sure that you use the right one always!