Best Crypto Tax Software Options 2024

Cryptocurrency has become the new normal of business and trading. It has taken the whole world by storm. From the four corners of the world, cryptocurrency touches all business entities like banks, some casino sites, and even the e-commerce sector. This has given way to Crypto Tax Software, which we shall explain below.

However, from the get-go, we need to set the record straight. The digital format of trading and business has moved many governments from various countries to come up with proficient taxation policies; policies that target the lucrative part of crypto, making regulations that act as checks and balances on profits. Taxation considerations took place the moment that cryptocurrency set foot on the digital financing platform.

One of the biggest challenges encountered by policymakers is that cryptocurrency has grown so big and has become so sophisticated. It now becomes mountainous to keep track of transactions and payments. Such complex digital systems belittle the capability of policy framers in coming up with standard and uptight taxation policies.

Digital confusion ends up gripping many cryptocurrency participants because they are not sure of how crypto will be managed. Millions and millions of money make their way through the digital street.

Though such a gross amount makes its way through the crypto mainstream, policymakers should become pertinent and simple when bringing about taxation regulations. The online setback is that crypto is at its hype and this means that the system is in a shifting dimension. As the world of crypto is shifting, policies should also shift.

The limelight is bright for many cryptocurrency holders because they are under the eyes of digital tax software packages. Crypto has been relinquished of some of its weight by this specified set of tax monitoring.

What are we really talking about when we raise the flag of Crypto Tax Software?

Table of Contents

What Is Cryptocurrency Tax Software?

Unlike the usual traditional financial stands of JPMorgan and Td Ameritrade, crypto has a different direction. Cryptocurrency exchanges should be understood well before you delve much more into Cryptocurrency Tax Software. Unlike traditional brokerages, this digital phenomenon does not offer forms.

In the place of forms, they come up with what is called 1099-K. 1099K enables crypto clients to view their various transactions and on top of that, you are simply aware of tax charges. A customer is only given a chance to view how many gross transactions they have made.

Carrying out the whole process on the spreadsheet is a task. Worry not because that’s when Cryptocurrency Tax Software comes into play. All those booms and recessions that you experienced during the whole year are perfectly calculated by this exciting software package.

Basically, the gist of the matter when it comes to cryptocurrency tax software is that transaction detail are bundled together and they base loss and gain calculations on US dollars. As the calculations are being made, a guide called IRS is used. With all this being said, it is fundamental for cryptocurrency holders to understand that when carrying out this process, the tax will include all the money you owe crypto and all gains but figures are not shown on the software platform.

Why Should You Use Bitcoin Tax Software?

Remember, when selecting cryptocurrency tax software, asses the country you are engaging from because some of the basic steps are not allowed there. It’s not all the countries that allow cryptocurrency taxing. Tax allocations are different in various countries. Avery country has its own regulations and they should be taken into consideration. It is pretty obvious that if your country charges tax on gross transactions, cryptocurrency tax software should be used. The best way to avoid any legal mishaps.

Best Cryptocurrency Tax Software

Koinly

If you are an absolute fan of investing and accounting, this is the software package to go for. It is a perfect way to calculate tax if a client has many accounts under cryptocurrency. Taxes are declared fairly while the customer of wallet holder enjoys the Koinly. In basic terms, Koinly major task is to get a combined assessment and solving of blockchain exchange-related challenges that come when you trade off Coinbase, Kraken, to mention just a few.

From a miniature amount of work, Koinly can drop the amount of crypto tax available. How do you do that? Well, a client should just create a link between the address of exchange accounts and the public address. After the fine connection has been confirmed, you can now wait for Koinly to make a clear calculation of capital profits.

Everyone has a tax agency when they start to facilitate cryptocurrency hence through that same agency, all your details are presented for you to print and keep in your file. Koinly themselves have their own filing destination. They often use TaxACT or TurboTax.

Koinly is very efficient as it helps wallet holders save time next to tax calculation. Very understandable and we recommend that you use Koinly. As a top-up move, Koinly also sends your wallet accounts using CSI or at-time API.

Price

There is a free version but if you more reputable wallet assistance, the initial price is $49 per tax year.

Pros

Koinly is good when it comes to the support line. They are viable and open all the time. All your expenses are monitored through Koinly. Tax assessment and general ledger detailing are top-notch.

Cons

Koinly has a lot of benefits to an extent that you fail to pick out any possible mishaps.

Blox

For all those enterprises and cryptocurrency account holders, they can use Blox to initiate a good account assessment and monitoring. Check out the available dashboard. The dashboard has all the basic details that are needed to provide transaction assessment. From analytics, previous transactions to available balances and assets.

All of these are found on Blox’s dashboard. It’s not all of us that have general knowledge about crypto, there are those individuals that are professional and expect something complex. Blox has got you covered through the provision of good financial options. If you seek financial assistance, this is the place to be because there is a wide assisting platform that covers anything to do with assets grouping and report creation. Synchronization of wallets and exchange wallets is very possible with Blox.

Price

Blox is very affordable though its exact figure has not yet been disclosed

Pros

Blox has state-of-the-art privacy. Your transaction history is safe and sound because it is strongly attached to efficient security systems like FaceID. These security operations do not only work for individual wallets but for enterprises also. A good starting point for fresh wallet holders.

Cons

Financial provisions are supplied to many destinations from accounting corps, startups, banking sector you name it and this can cause some form of digital confusion.

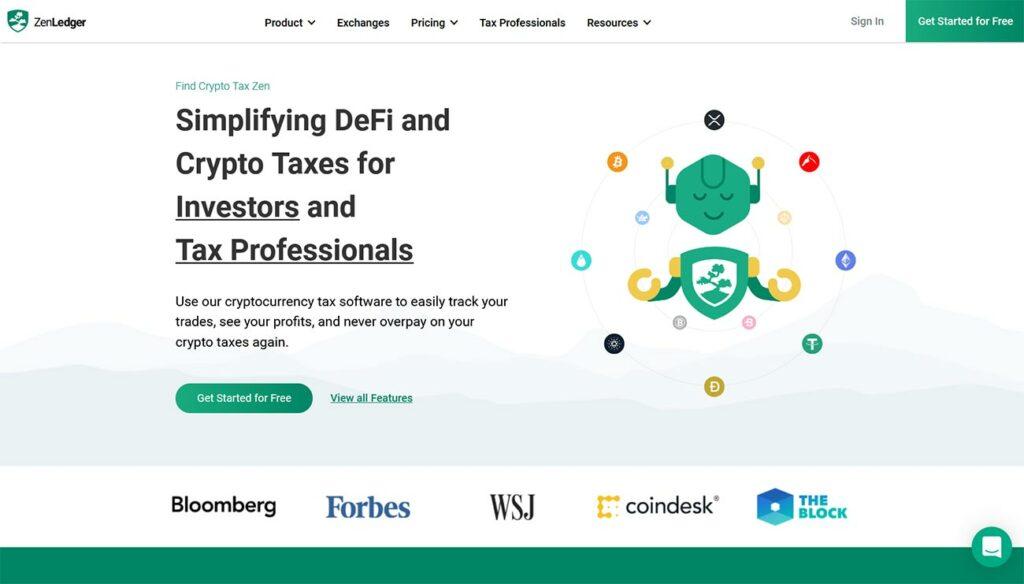

ZenLedger

ZenLedger is strongly linked with IRS and from the get-go, you can easily see that it is very efficient. ZenLedger operations are wide and cover many sectors. From digital transactions, accounts exchanges, and fiat transactions, they are all backed up by ZenLedger.

ZenLedger is strongly linked with IRS and from the get-go, you can easily see that it is very efficient. ZenLedger operations are wide and cover many sectors. From digital transactions, accounts exchanges, and fiat transactions, they are all backed up by ZenLedger.

Everything is automated meaning that clients do not have to wait long for the tax to be calculated. Tax calculations are made for most of the Bitcoin mining community and daily traders. Very audible on the most prolific establishments like Forbes and Bloomberg.

Price

Most of ZenLedger tax and account processing is done at no cost.

Pros

It has a simple, efficient, and interactive interface that gives the account holder a chance to create reports on capital gains. On the list also are donation and closing reports. The cordial nature that exists between IRS and ZenLedger is exceptional when it comes to tax minimizations.

Cons

ZenLedger has a limitation when it comes to transaction quantity. Anything above 25 is prohibited. It now becomes expensive and demanding too many day-to-day traders because they have to use the premium package which charges a top-up cost for the assistance.

TaxBit

We have been talking about banking forms, mining corporates, individual wallet holders but have you ever wondered which software covers professional personnel like lawyers and accountants? Well, TaxBit has got all of them covered. All those tech gurus are also covered also.

What it does is that it creates an application geared to facilitate refund on tax preparations. The whole process is a two-step process. The initial step entails the synchronization of transaction data by using a combined and monitored API.

API can be replaced with CSV conversion options. In the second step, you have to download a specific form called IRS Tax Form 8949. The form is flexible enough to be uploaded on TurboTax or TaxAct. Rather than sending it to those platforms, TaxBit can as well send it to your accountant.

Price

TaxBit, unlike most software, is a bit costly.

Pros

Worldwide coverage is broad because it has the ability to support many currencies. It’s not only that but can also support various commodities, good equities, and fiat.

Cons

TaxBit is selective to a certain group.

BearTax

If you are a fund manager or accountant, BearTax will be appropriate for all your needs. It is also an efficient and reliable way of tax software calculation if you are a day-to-day bitcoin and altcoin trader. Comes with a subtle and reputable transaction processing unit that is able to facilitate thousands and millions on every single minute, very astonishing. Like many software, API and CSV can be used on 50 or above crypto exchanges. Some of the basic exchanges include Binance, Poloniex, KuCoin, Conibase, and Bittrex.

Price

The price is unknown.

Pros

Fused with an efficient algorithm to deduce tax charges on all your available transactions from your wallet to another. IRS is good when it comes to good documentation. IRS also enables easy transfer of files and the movement of funds.

FIFO and IFO are also facilitated by BearTax. If you seek financial and private engagements, BearTax has got you covered. Unlike many software, BearTax has an efficient list of countries that include the USA, Australia, and Canada.

Cons

Has a limited number of support teams. Though the amount of exchanges is around 50, it is still low.

Bittax

Bittax is reputable as it is backed up by Blockchain. All the available tax results are explicitly offered and transactions are monitored clearly. Bittax is basic unlike BearTax because it follows the common software expectations like tracking and wallet consolidations. Among wallet consolidations, you can find blockchain processes as part and parcel of the operation.

Bittax is reputable as it is backed up by Blockchain. All the available tax results are explicitly offered and transactions are monitored clearly. Bittax is basic unlike BearTax because it follows the common software expectations like tracking and wallet consolidations. Among wallet consolidations, you can find blockchain processes as part and parcel of the operation.

Price

Affordable since it has an average provisional supply.

Pros

Calculations are based on reports hence everything is legit and straight. Wallet holders have an opportunity to check out historical data. Very easy to obtain all the tax reports thereby making it easy to assess all there is to know about tax laws and details.

When it comes to sheer accuracy and correctness, Bittax has got you covered because it has state of the digital art software compatibility. Tax reports are available most of the time. Everything is technical from Bittax because you can easily come up with all tax liabilities. This is possible without tempering transaction privacy.

Cons

Too basic and lacks cryptocurrency explorations. Mainly focused on technical calculations.

BlockSentry

Yes, BlockSentry is the mastermind when it comes to absolute saving. The filing of tax reports is also fast. Traders and investors can engage properly in what is called end-to-end digital compliance. BlockSentry allows proper means of adopting properly while respecting the available regularities. Visuals of all transaction data are explicitly shown while you also grab a chance to check out all there is to know on transactional performance.

Price

BlockSentry price is still unknown but it is affordable.

Pros

Highly developed piece of tech that has reputable user guides and digital intelligence. Form filling is automatic.

Cons

BlockSentry is no brainier for newbies in cryptocurrency transacting due to its absolute advances.

CoinTracker

The latest reviews from CoinTracker show that they have engaged 100,000 clients so far. On top of that huge figure, they have made connections with over 300 crypto exchanges. The list goes on to include 2500 digital currencies that have received gross usage from clients. Capital loss and transaction volumes figures are totally different as they stand at $20 billion and $600 million respectively.

Price

Very cheap yet undisclosed

Pros

It is very broad. Data sync is highly possible with CoinTracker. Can support many destinations.

Cons

Too basic and has a tendency of leaking capital gains.

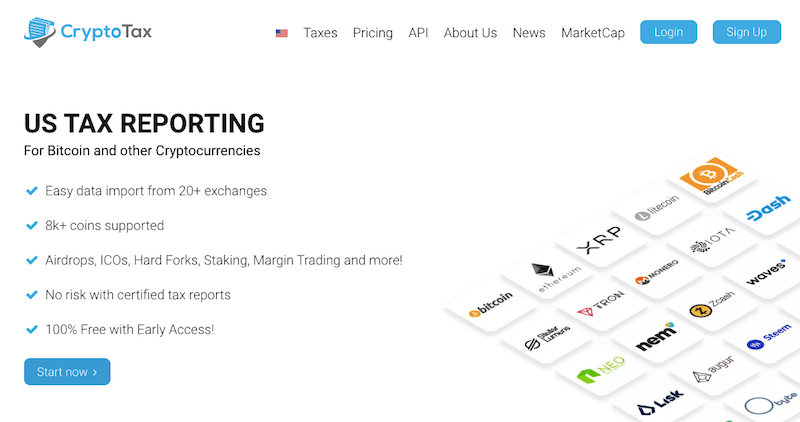

CryptoTax.io

Dubbed the most reliable and efficient tax software, it is a European and American software package that covers countries like Germany and the USA. The Swiss are also in the mix.

Price

Tax charges are above $100 per tax year.

Pros

Very interactive. Has an understandable interface that caters to security and law allocation. The use of API makes it possible for clients to make a clear assessment and monitoring of transaction data.

Cons

Client linkage is centralized to Europe and America. Digital transactional support is still low-key.

CryptoTaxCalculator

The most basic part played by CryptoTaxCalculator is the deduction of tax liabilities. This is made possible by an automated calculator that gathers all the available transaction history.

Price

Mostly unknown.

Pros

It is linked with the most important crypto exchanges like Bittrex and Binance. The link that exists between API and other transaction provisions makes it possible for a client to detail. Personal and aggregated databases are quickly updated by CryptoTaxCalculator. Has fantastic security measures that allow clients to protect their transactional history.

Cons

Lacks interesting diversity.

Ledgible by Verady

If there is software that has legible and operational transactional processing, it is Ledgible by Verady. Creates a link between cryptocurrency and blockchain. Blockchain has a lot of influence on this selection because all the accounting and integration processes rely on Blockchain.

If there is software that has legible and operational transactional processing, it is Ledgible by Verady. Creates a link between cryptocurrency and blockchain. Blockchain has a lot of influence on this selection because all the accounting and integration processes rely on Blockchain.

Binance and Poloniex are part and parcel of the available exchanges. Testimonies have come from Aprio, Storj, and Mazars who have been using Ledgible for a long time. Unlike some software, Ledgible has an option that allows clients to view various digital assets.

Price

Still unknown

Pros

Everything is legit and properly done from Ledgible because they carry out audits and digital calculations. Tax solutions are offered in their entirety. The website is easily accessible if you have any queries and the whole interface is fully functional.

Cons

It has a narrow client base and option selection.

What Should You Look For In Crypto Tax Software?

So much should be expected from crypto tax software. If you are a bitcoin or altcoin trader, below are some of the basic steps available.

Price

Remember, each and every tax software has its specific price. Free tax tools are good but they are not very efficient. In other words, they have huge loopholes.

Data Security

Are you satisfied with your tax software? Security is fundamental to transaction history.

Credibility

Legal amenities are considered when coming up with exceptional means of credibility. Information that is wrong can be sent to your wallet and this can jeopardize your operation.

Team

Are you really aware of the people that are behind software development? If you are not aware, it’s high you do so.

Integrations

All there is to know here is that there are two provisions, Application Programming Interface (API) and Comma Separated Values (CSV). They ensure integration.

Bandwidth

Caters for clients that have many transactions and many cryptocurrency accounts or wallets.

History

This entails transaction history, multiple reviews, and forums.

Media Presence

Remember, media presence is all about visuals on how that certain tax software offers products and services. There are many pieces that are compiled by many journalists to detail on those packages.

Affiliations

Check out how many and types of companies are attached to the tax software.

How To Get Started With Cryptocurrency Accounting Software

- Get an exchange list and the number of transactions.

- Make a revised calculation of losses and amount of gains by deducting costs. Follow the formula Capital Gain or Loss = Selling Price – Cost-Basis.

- Opt for IRS form 8949 and fill in the details.

- Send filled details to the 1040 Schedule D form.

- The remaining cryptocurrency details are filled in on the earlier mentioned 1040 form. Make sure that all the details are filled in because the form is for mining, paid-up crypto, or airdrops.

F.A.Q.

Should I get cryptocurrency tax software?

Yes, you should. However, you should always consider the crypto environment you operate in.

Which crypto transactions are taxable?

The taxable crypto events include selling crypto for fiat currency, buying goods and services using crypto, trading crypto for crypto, and more.

Can I avoid crypto tax?

No, you cannot. It’s important to know that all crypto transactions are taxable. As a result, you will not be able to run away from crypto tax.

Conclusion

Gains and losses are calculated perfectly with tax software. A cryptocurrency tax calculator is a way to go. Make a quality assessment of how efficient is your chosen tax software