CryptoTrader.Tax Software Review 2024

There are many countries around the globe that are starting to more seriously enforce cryptocurrency tax reporting requirements. If you have not been keeping a detailed record of all of your cryptocurrency transactions, reporting can become a time consuming and challenging task. CryptoTrader.Tax is a platform that is built to make your crypto tax reporting a fast and simple process.

This article will provide you with more details about this tax management software and help you to start using it for your benefit.

Table of Contents

What is Cryptotrader.Tax

CryptoTrader.Tax is a crypto tax management software created for calculating trading gains and losses and preparing official tax reports on them. It is one of the most user-friendly tools which makes tax reporting much less painful. The software has built a large historical database of all crypto prices so the tax reports provided are known for their accuracy down to the minute. As a result, every user can create and send his or her tax report with the click of a button without spending hours preparing it. The platform offers access to all reports made between 2010 and 2018 years.

There are several types of crypto tax reports to be created on the platform:

- Audit Trail Report (shows the numbers used for calculating trading gains).

- IRS Form 8949 (includes all of your short term and long term gains from cryptocurrency trading).

- Short & Long Term Gains Report (includes Cost Basis, Proceeds, and Net Gain/Loss).

- Cryptocurrency Income Report (includes Gifts, Mining, and Income).

How Does it Work?

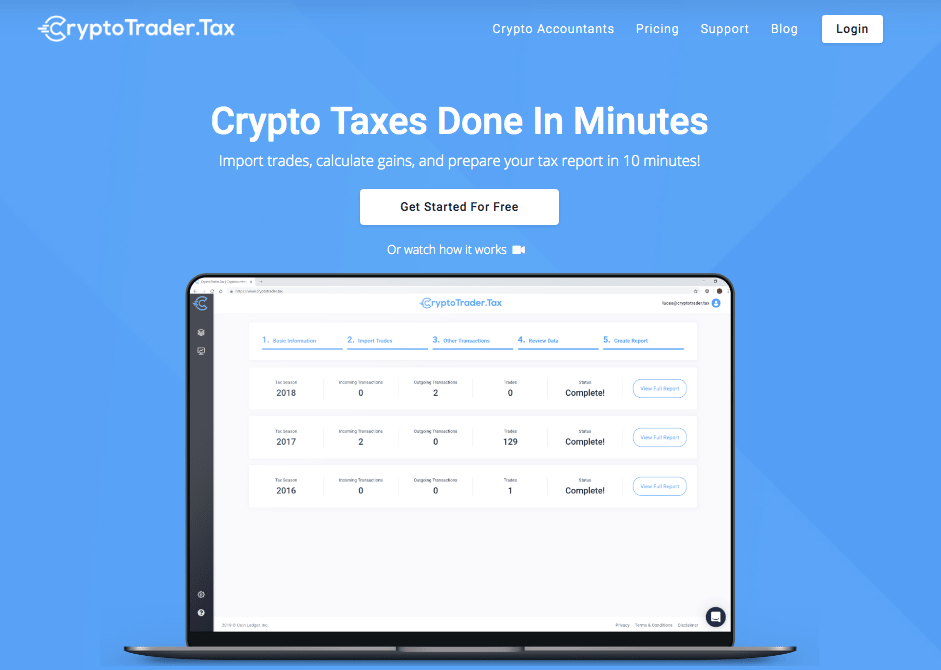

Without the use of software, creating your crypto tax reports can take hours if not days; however, with Cryptotrader.Tax this process takes only several minutes. To build your tax report, follow 5 simple steps:

- Select one or several exchanges you have used

- Import your trades

- Add your crypto income as well as other crypto transactions

- Look through the data provided to ensure its accuracy

- Create your tax report and download from the platform

The main benefit of Cryptotrader.Tax is the support of all the existing crypto exchanges, so there are no difficulties in importing a user’s trading history. There is an import guide on every exchange, and it can be accessed directly from the platform by clicking it. This helps to walk users through the import process. It is important to provide data from all exchanges and from all years so that you do not miss any transaction data.

CryptoTrader.Tax Features

The platform is quite versatile offering its users multiple features including:

- Support of multiple cryptocurrencies;

- Simplified data import;

- Data visualization;

- Tax management;

- Different tax calculation modes;

- Income, opening, and closing balance reports;

- Yearly long and short-term balance summary;

- Possibility to export to Excel, CSV, and PDF;

- Easy tax reporting with TurboTax.

Supported Crypto Exchanges

When it comes to the list of crypto exchanges supported by Cryptotrader.Tax, it includes both the most prominent and gaining popularity services such as:

- Coinbase;

- Bittrex;

- Bitstamp;

- Gemini;

- Poloniex;

- Binance;

- KuCoin;

- Kraken;

- Huobi etc.

The total number of exchanges supported is 23. These are ALL trusted crypto exchanges existing on the web nowadays. Users can import their trades automatically from these platforms using their API keys, or can import the CSV transaction history file that their exchanges exports to them.

How to Switch Your Crypto Taxation to CryptoTrader.Tax

Every crypto trader realizes the importance of providing accurate data, and that is one of the reasons why CryptoTrader.Tax platform is a good choice to calculate tax liability for crypto holders. This platform prevents traders from overpaying as well as minimizes the tax liability.

Even if a person used to make up crypto tax documentation manually previously, it will not cause any difficulties to switch to this simplified variant.

Registration

The first step to make for every trader is to sign up for CryptoTrader.Tax platform. It is an absolutely free procedure without any obligations or information about users’ credit cards or personal identifying information.

The only information you need to provide is your email and password. The platform also encourages its users to read Terms and Conditions and agree with the information mentioned there. As soon as you confirm your email following the link, you can login your account and start working on your tax report.

Free Plan

The cost of the report ordered from CryptoTrader.Tax depends on the number of trades made. However, there is a free plan too. It allows users to:

- Import Trade History;

- Import Crypto Income;

- Connect with Live Chat Support.

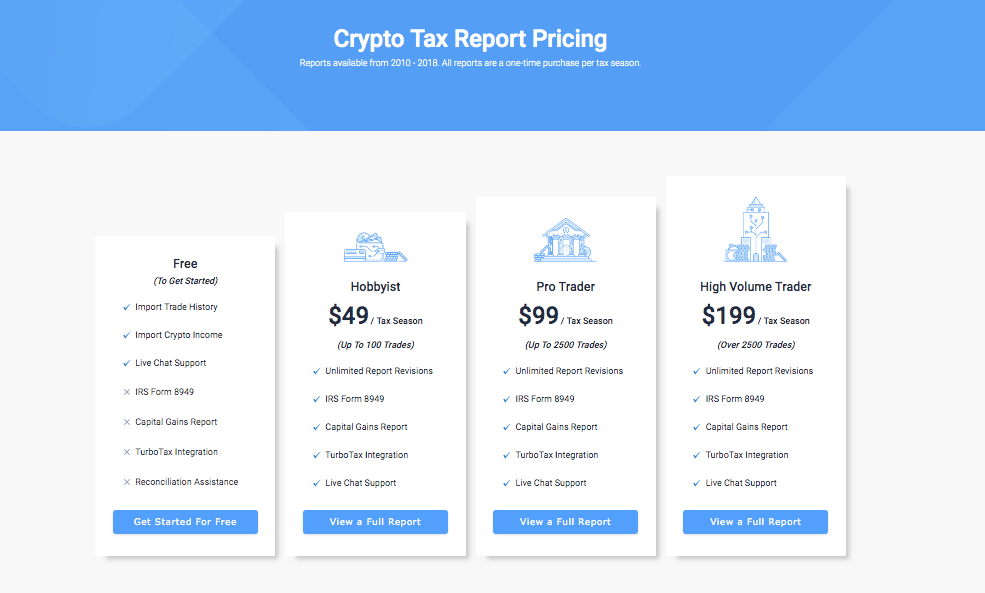

Pricing

At the same time, if a user wants to get a tax report and access all the functionality of the service, it is necessary to buy one of three paid packages. Each of them differs in the number of trades and cost but includes the following features:

- Unlimited Report Revisions;

- IRS Form 8949;

- Capital Gains Report;

- TurboTax Integration;

- Live Chat Support.

Hobbyist

This plan is suitable for users with up to 100 trades and costs $49 per tax season.

Pro Trader

The following plan is for users with up to 2,500 trades and its price is $99 per tax season.

High Volume Trader

Users of this plan have made over 2,500 trades and need to pay $199 per tax season.

How to Pay Taxes

CryptoTrader.Tax is the first cryptocurrency tax company to partner up with TurboTax. The last one is the software used for tax preparation. It is enough to import both gains and losses into TurboTax Online or a desktop version of this software to allow every user to E-File crypto gains and losses with his or her full tax return.

Taxes are paid in the national currency of the country where you live. In the US, for example, it is necessary to convert cryptocurrency to the dollar and then pay taxes. The IRS states that it is necessary to determine the fair market dollar value of the cryptocurrency as of the day a person received it for complete cryptocurrency taxes reporting.

Support

If users of the service have any questions or want to learn more about the process of preparing a tax report, it is possible to open the Support tab and read articles as well as answers to FAQ. There are four sections which include Getting started Guides, Common Issues, FAQs, and Taxes.

If there are any issues which are not mentioned in any of these sections and articles contained there, it is possible to send a message at [email protected].

Affiliate Program

One more pleasant benefit was prepared for affiliates since CryptoTrader.Tax will reward everyone who attracts new users to the platform. It offers to earn a 25% recurring commission for each referred customer.

Moreover, there is one more benefit for Cryptalker users who can use coupon code CRYPTALKER10 and get a 10% discount on all tax reports.

Conclusion

CryptoTrader.Tax is a great service for people who do not want to waste their time for time-consuming calculations and filling in the forms to make up tax reports on their crypto gains and losses. With this software, this process gets much faster and less painstaking as well as minimizes possible mistakes. For more information about crypto tax calculators like CryptoTrader.Tax, you can visit their website.