Cheapest Way to Buy Bitcoin: Step-by-Step Guide

With a market cap currently exceeding $710 billion, Bitcoin is, by far, the most significant and valuable cryptocurrency in existence. This digital currency offers a variety of uses. For some, Bitcoin is a convenient payment method, whereas to others, it is an investable asset which can provide a genuine return. Whatever your reason for wanting to buy Bitcoin, it is always a good idea to shop around. This guide will show you how to find the cheapest way to buy Bitcoin.

The sale price of Bitcoin can vary, sometimes significantly, depending on which platform you buy it from. In many cases, the overall cost of the cryptocurrency also varies depending on the payment method you have selected to pay with. The difference in cost might seem insignificant at first, especially if you are seeing its value in fiat currency.

However, you need to remember that Bitcoin’s price is extremely volatile, and a difference of a few dollars today can result in hundreds of dollars in the future. If you have trouble understanding this, imagine that you bought Bitcoin in July 2016, when the coin’s price hovered around $600. Overpaying for Bitcoin by just $1 would translate in December 2017, as an overpayment of almost $33 per coin.

Now, imagine repeating this over-payment across several different trades and with larger volumes. You’d end up losing hundreds of dollars simply because you didn’t buy Bitcoin in the cheapest way.

Table of Contents

How can you buy Bitcoin cheaper?

Bitcoin price is going to be almost the same on all the websites. The place where you can save money is on the markup, deposit fees, and withdrawal fees. You can lower down your cost based on factors such as:

Which country you are from

What is your preferred mode of Payment

How much time you can wait for buying Bitcoin

Do you wish to withdraw Bitcoin or use the exchange as a wallet (Not recommended)

How tech savvy you are

Here are a few things you should know:

Buying using a bank account is the cheapest

Buying using a credit card is the costliest (I have given the cheapest solution below)

Using P2P exchanges like Paxful or Localbitcoin is the cheapest, but they are not the most convenient way to buy.

A quick guide on buying BTC cheaper

Create a short “Quick” step-by-step guide” on how to buy Bitcoin on Binance

Step 1: get a Bitcoin wallet

Before you buy bitcoins, you’ll need to set up a Bitcoin “wallet”. A Bitcoin “wallet” is just a virtual storage center, just like your physical wallet is what holds your cash and debit and credit cards.

Step 2: choose a Bitcoin exchange

After you have a wallet, you’ll need to register with a ‘fiat-to-crypto’ exchange. This means a company that accepts regular money in exchange for cryptocurrency such as Bitcoin. In crypto parlance, ‘fiat’ currency is any government-issued money like U.S. Dollars, Euros, or Sterling.

When you buy bitcoin from a fiat-to-crypto exchange, the company sells you cryptocurrency from their own reserves. This means that they can set the price and charge a fee for their service. For this reason, fiat-to-crypto exchanges are sometimes referred to as ‘broker exchanges.’

Step 3: register and complete security checks

Once you’ve found an exchange, you’ll need to register and complete security checks. The exact details will vary from one exchange to the next. Nevertheless, in general, you must visit the exchange’s homepage and click on “Register.” Once you enter your email address and choose a password, the exchange will send you a confirmation email.

Next, open your email inbox and click on the link. This will take you to the dashboard page of your new cryptocurrency exchange account.

Step 4: complete security checks

From your main screen, the dashboard, you’ll notice there will be a few more steps to complete before you can start buying bitcoin. These steps vary between different exchanges but typically involve satisfying anti-money laundering and ‘Know-Your-Customer’ rules of the country in which the exchange is located.

Most exchanges ask you to add your phone number. This allows two-factor authentication (2FA) and prevents anyone from accessing your account without having access to your password and phone. 2FA effectively adds extra security to your account by requiring you to enter your password and a short code sent to your phone when you log in to your account or make a major transaction.

Next, you’ll be asked to upload a photo or scan of your ID, such as your passport or driver’s license. Some exchanges ask for a selfie, while others use an employee to conduct an ID check over your webcam.

Step 5: add a payment method

You must add a bank account, debit card, or credit card to make your first bitcoin purchase on most exchanges. Adding a bank account is recommended for buying large amounts of bitcoin as the transfer fees tend to be lower. Credit and debit cards are only recommended for smaller purchases as they carry higher fees. If you’re buying a large amount of bitcoin, it’s unwise to use a card.

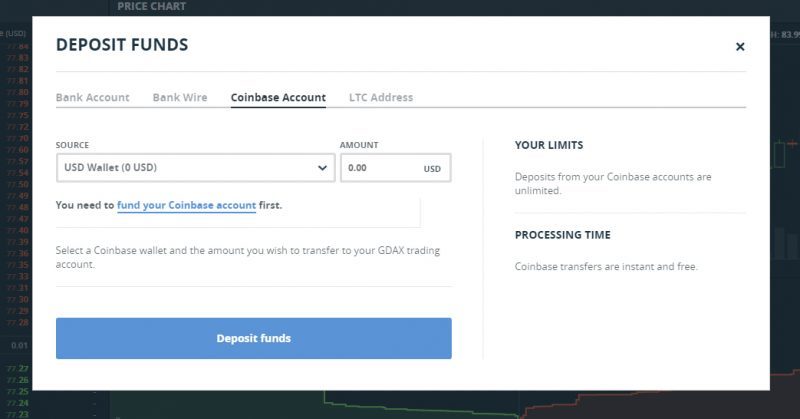

Step 6: deposit funds to your exchange account

How Do You Buy Bitcoin? – A Beginners Guide To Buying And Selling Bitcoin – Deposit funds into your exchange

For this step, choose the amount of cash and transfer it to the exchange. The fees and time will depend on the payment you chose. Card purchases can be instantaneous, while bank transfers may take a little longer to go through.

Once you’ve completed this step, you’ll have money in the ‘fiat’ wallet of your exchange account. You can use the cash to buy Bitcoin.

Step 7: buy Bitcoin with cash, or get paid in Bitcoin

The final step is to use the cash in your exchange wallet to buy Bitcoin. Click on the ‘Buy/Sell’ button and select the value of altcoins you wish to purchase.

Once you’ve agreed to the transaction costs, like transaction fees, click on “Buy” and wait for the transaction to be completed.

Those who don’t have the technology or understanding of complex computer software, can buy bitcoins with cold hard cash, credit or debit cards (apps like Coinbase currently accept Visa and Mastercard), and wire transfers. You can spend as much as you like, and you obviously don’t have to buy a whole bitcoin. You can purchase fractions of bitcoins.

You can also get paid with bitcoins. If you’re trying to break into the Bitcoin world, finding a side hustle that pays you in bitcoin is a great way to get started.

What is the cheapest place to buy Bitcoin?

Binance

Although Binance was only established in 2017, it has already captured the trust of millions of users due to its vast offering of altcoins, good customer support, and some of the lowest fees to buy Bitcoin.

Binance charges a trading fee of just 0.1%. Interestingly, this fee can be reduced even further by using the BNB coin (Binance’s native cryptocurrency) to pay trading fees.

Binance also charges a withdrawal fee of $1-5 depending on the cryptocurrency that you are withdrawing.

These low fees make Binance a great way to buy cheap Bitcoin. However, on the contrary to Coinbase or CEX, you won’t be able to use bank transfers to make the purchase.

PROS

Low trading fee of just 0.1%

120+ coins available (in addition to Bitcoin)

Very high security standards

CONS

Interface can be confusing for beginners

No option to buy Bitcoin with USD, EUR, or GBP

Coinbase

Coinbase is often referred to as the simplest way to buy Bitcoin. The exchange has been around since 2014 and enables its users to buy Bitcoin and 10+ other cryptocurrencies very easily.

Coinbase charges a 1.49% trading fee which is charged whenever you buy or sell cryptocurrency on the exchange.

To buy Bitcoin cheap on Coinbase, avoid depositing funds with your credit card since an additional 3.99% fee will be charged. If available in your jurisdiction, do a SEPA transfer or ACH transfer instead since both are free.

You will pay at least 1.49% of your purchase amount as a fee when you buy Bitcoin with Coinbase. Coinbase will charge at least 3.99% of your purchase amount if you use a credit or debit card to buy Bitcoin.

PROS

Amazing user interface

Good customer support

10+ cryptocurrencies available

CONS

High credit card deposit fees

CEX.IO

CEX is a low fee Bitcoin exchange that is also great for beginners due to its intuitive user interface. The exchange has been around since 2013 and has proven to be safe and reliable in that time.

CEX is a low fee Bitcoin exchange that is also great for beginners due to its intuitive user interface. The exchange has been around since 2013 and has proven to be safe and reliable in that time.

CEX is one of the very few Bitcoin exchanges that do not charge a withdrawal fee. The only costs associated with buying Bitcoin on CEX are a low trading fee of just 0.25%.

If you want to buy Bitcoin cheaply, do not make use of CEX’s “Instant Buy” feature. Buying Bitcoin through the “Instant Buy” box comes with a hefty 7% fee.

Furthermore, you should also only deposit money with a bank transfer or SEPA, since that will be free. If you make use of VISA or Mastercard to buy Bitcoin on CEX then you will be charged an additional 3.5% fee.

PROS

Low trading fee of just 0.25%

Intuitive to use

Available 220+ countries

CONS

“Instant Buy” feature comes with a hefty fee

Coinmama

Having launched back in 2013 and served over 1.3 Million customers, Coinmama is not only one of the cheapest ways to buy Bitcoin for beginners, but also a very trustworthy option.

Although Coinmama charges a 5.5% transaction fee, which is higher than other exchanges, it balances that out by offering a low Bitcoin price and not charging any big spreads on top of it.

To buy Bitcoin as cheaply as possible on Coinmama you should deposit funds using SEPA, and not your credit card. If you make a credit card deposit, then an additional 5% fee is charged.

PROS

Great customer support

Fast identity verification process

Simple user interface

CONS

Not the Bitcoin exchange with the lowest fees

High credit card deposit fees

LocalBitcoins

Local Bitcoins was launched in 2012 as a platform enabling in-person trades in Bitcoin. Throughout the years, the exchange has become very popular in countries that have banned Bitcoin.

Local Bitcoins charges a 1% fee whenever a trade is completed through the platform. However, the fee structure gets a bit more complicated than that, unfortunately.

Since Local Bitcoins is a peer-to-peer trading platform, the individual that has the liquidity to fulfill your order (either to buy or sell Bitcoin) decides the commission that he charges you. This commission usually ranges from 5 to 12%.

At the time of writing, LocalBitcoins is the peer-to-peer Bitcoin exchange with the lowest Bitcoin fees.

PROS

Cheap way to buy Bitcoin in countries where its banned

CONS

Commissions can be high in some cases

Meeting in person with a Bitcoin seller can be dangerous

User interface is not very intuitive

Bitstamp

Bitstamp is a prominent Bitcoin exchange that has been up and running since 2011. It is licensed with the Ministry of Finance in Luxembourg. While other options are better for acquiring smaller amounts, Bitstamp may be the best platform to buy large amounts of Bitcoins.

Bitstamp is a prominent Bitcoin exchange that has been up and running since 2011. It is licensed with the Ministry of Finance in Luxembourg. While other options are better for acquiring smaller amounts, Bitstamp may be the best platform to buy large amounts of Bitcoins.

Payment methods for deposits and withdrawals include SEPA bank transfers, credit, and debit cards. To buy supported crypto assets, people can also use credit cards.

Pros:

Customer support is very good

Trades are quick

Plenty of resources for analysis

Licensed and transparent

Easy to use

Cons:

The process for the registry is long and somewhat confusing

It has confusing fees

Kraken

Kraken is a big American crypto exchange that operates globally and is founded in 2011. It is currently considered the world’s largest bitcoin exchange in euro volume and liquidity. Payment methods include bank transfer and SEPA credit transfer, both for deposits and payouts.

Pros:

It comes with an integrated wallet

It offers business accounts in addition to regular ones

It has two-factor authentication

Cold storage

Multisig wallets

Cons:

It has experienced more than a few technical issues and downtimes in the past

The user interface looks outdated

Gemini

Gemini is a famous Bitcoin exchange administrated by the Winklevoss twins. However, it does not accept common payment methods such as debit cards, credit cards, cash, or checks. To buy Bitcoin online in Gemini, the person needs to link its bank account and initiate an ACH deposit or wire transfer.

Gemini is a famous Bitcoin exchange administrated by the Winklevoss twins. However, it does not accept common payment methods such as debit cards, credit cards, cash, or checks. To buy Bitcoin online in Gemini, the person needs to link its bank account and initiate an ACH deposit or wire transfer.

Pros:

Good reputation

Licensed in 42 US states and numerous countries around the world

Instant Deposit for ACH Transfers

It offers dollar-to-crypto and crypto-to-crypto trading

Cons:

The interface is not that user-friendly

It severely lacks in payment methods

Not very good for privacy

Bitcoin ATM

Similar to traditional ATMs, a Bitcoin ATM is a portal through which users are able to engage in a financial transaction. The difference here is that traditional ATMs allow users to withdraw and deposit cash whereas Bitcoin ATMs allow users to buy and sell Bitcoin using cash. While some of the early versions of Bitcoin ATMs (and the majority of those in operation today) did not allow its users to sell Bitcoin as well, Coin Cloud ATMs allow users to both buy Bitcoin using cash and sell Bitcoin for cash, safely and securely.

Bitcoin ATMs are comprised of a monitor, QR scanner, bill acceptor and dispenser. On the backend, these components are tied together via software to make the buying and selling of Bitcoin quick, easy and secure.

However, Bitcoin ATMs are different than traditional ATMs in that they are not connected to a bank account. Instead, they are connected directly to a cryptocurrency exchange via the Internet. These exchanges are what allow users to buy and sell Bitcoin instantly.

The very first Bitcoin ATM was placed in 2013 at the Waves coffee shop in Vancouver, Canada. That ATM has since been removed, but it was this machine that paved the way for other Bitcoin ATM companies to innovate and carve out their niche in the industry.

What fees are there when buying Bitcoin?

There are 5 main costs associated with buying Bitcoin on an exchange: trading fees, credit card fees, bank transfer fees, spread, and “instant buy” fees,

Trading fees and the spread (premium on the BTC price) charged by the exchange cannot be circumvented.

However, if you want to buy cheap Bitcoin, then you should avoid using credit cards or the “instant buy” feature to buy Bitcoin.

Instead, simply deposit funds with a bank transfer, and then place a regular buy order on the exchange.

How to find the cheapest place to buy Bitcoin?

There are a few things that you need to keep in mind when looking for the cheapest Bitcoin exchange. These range from security considerations, to hidden fees. Let’s briefly dive into each one before we end this guide.

The best way to buy cheap Bitcoin is to research different crypto exchanges. That’s the only way to find platforms with the best deals for buying and selling Bitcoin. In some cases, you can even get free Bitcoin. Although this might not sound true, it’s possible. However, you will have to do some work.

For instance, you can use the BTC faucet to get Bitcoin for free. BTC faucet is a site that allows you to get a Bitcoin fraction for performing a simple task like watching some ads.

You can also participate in crypto bounty programs. These programs allow you to earn Bitcoin by performing some content creation tasks on social media.

Safety

If an exchange claims to be the cheapest way to buy Bitcoin, could it be offering that at the cost of security? Securing a cryptocurrency exchange is expensive, and if an exchange has no income from trading fees then it’s questionable whether they have enough funds to perform decent security audits.

Another consideration is potential scams, which lure new users in with attractive “0% fee offers”. To stay safe, stick to the exchanges that we recommend in this guide.

Hidden fees

Another point to watch out for are hidden fees, which can come in the form of a spread or putting your data for sale.

One example for this is the exchange “RobinHood”, which got widely popular due to its zero-fee policy but also publicly admitted to selling the data of its users to high-frequency traders.

Ease of use

Finally, many exchanges that offer a very cheap way to buy Bitcoin are tailored for traders and experienced market participants.

Although the fee structure may seem attractive to you, you will have to stop and think if you are already experienced enough to be interacting with these platforms.

Privacy and security tips

Research

The best way to handle this high-risk investment is to know what you’re investing in and have a strategy.

Buying cryptocurrency is similar to buying stocks, but it is still in its infancy stage. That’s one of the reasons it’s so volatile. And with over 4,000 currencies out there, you have a lot of options to explore. Unfortunately, there isn’t a crypto equivalent to an index or mutual fund to help guide you. You’ll have to look into individual coins for yourself and decide which ones you believe will be profitable in the long term.

And you also won’t have the same protections. If you buy stocks and the brokerage fails, the Securities Investor Protection Corporation (SIPC) provides coverage to protect your investments. If your money is in the bank, it will be FDIC insured. You’re not quite entering the wild west, but some of the protections we take for granted don’t exist with Bitcoin.

Choose your exchange or brokerage wisely

There are several ways you can buy Bitcoin, including an exchange, a brokerage, a Bitcoin ATM, or a peer-to-peer network. Check out our list of the best places to buy Bitcoin to find the right option for you.

Many cryptocurrency exchanges have resources available for beginner investors. And all the reputable firms have invested heavily in security and anti-hacking measures.

To help you choose the right exchange or brokerage, here are some things to consider:

Is it secure? Has it been hacked? What percentage of its assets are stored offline?

Is it insured? Some exchanges have taken out their own insurance against fraud and theft.

What are the fees like? How much will you pay to deposit or withdraw money?

Can you sign up from your state? Some exchanges don’t operate in every U.S. state. New York, in particular, has stricter restrictions on crypto activity.

Decide if you want a hot or cold wallet

When you first buy Bitcoin, you may think you don’t need your own private crypto wallet and decide to keep your coins on the exchange. However, a wallet is a good idea because an exchange is more vulnerable to hackers, and you don’t hold the keys.

Once you’ve chosen one of our top-rated brokers, you need to make sure you’re buying the right stocks. We think there’s no better place to start than with Stock Advisor, the flagship stock-picking service of our company, The Motley Fool. You’ll get two new stock picks every month, plus 10 starter stocks and best buys now. Over the past 17 years, Stock Advisor’s average stock pick has seen a 566% return — more than 4x that of the S&P 500! (as of 6/17/2021). Learn more and get started today with a special new member discount.

Unlike the U.S dollars in your bank account, you can’t hold your Bitcoin in your hand. Instead, you own public and private keys — and if you don’t control the keys, many believe that you don’t truly own your coins.

That’s where wallets come in. Hot wallets are connected to the internet and are usually free. They are useful for keeping assets you might want to trade or spend.

A cold wallet is a physical device that is not connected to the internet. This is an extremely secure way to keep your cryptocurrency and a better option for large amounts of money. Even if someone steals the device, only you have the access codes. You’ll pay between $50 and $150 for a cold wallet.

Deposit funds

If you haven’t bought Bitcoin before, you’ll first need to deposit some fiat currency, such as U.S. dollars, into your account. You can usually do this by bank transfer, debit card, or credit card.

You may need to provide your name, address, and photo ID. In some cases, you’ll need to provide proof of address. It’s also worth checking to see if your bank will allow the transaction. Mine, for example, threw up several additional warnings about fraud and security before I could transfer money.

While you can use a credit card to deposit funds, it’s not advisable. You will often pay a higher fee than with a bank transfer or debit card. Also, your credit card company may treat it as a cash advance, which comes with high fees and starts to accrue interest immediately.

Buy your Bitcoin

After all that preparation, this step is perhaps the easiest. Log in to your exchange or brokerage account and choose how much Bitcoin you want to buy. That’s it. You’re now the proud owner of your very own piece of Bitcoin.

One final note: It’s natural to be tempted by the high-profile profits people have earned with Bitcoin. And you may be scared you’ll miss out if you don’t invest now.

Even so, it’s not a good idea to invest money you can’t afford to lose. If you’re saving your money for future plans, such as buying a house or retirement, don’t risk investing in Bitcoin. And make sure you have a solid emergency fund before you do begin.

Be aware that you’ll need to pay taxes on your Bitcoin. Make sure you keep track of what you buy and sell so that you can declare it correctly come tax season.

There’s a lot of risk involved with buying Bitcoin. By following these steps, you have a better chance of protecting your investment.

F.A.Q

Q: What costs are there when buying Bitcoin?

There are 5 main costs associated with buying Bitcoin on an exchange: trading fees, credit card fees, bank transfer fees, spread, and “instant buy” fees,

Trading fees and the spread (premium on the BTC price) charged by the exchange cannot be circumvented.

Q: Is it possible to get Bitcoin for free?

So you not only want to get cheap Bitcoins, but you also want to get Bitcoin for free?

Contrary to popular belief, getting Bitcoin for free is indeed possible. However, there will be some work involved.

One of the simplest ways to get some Bitcoin for free is by using a BTC faucet, which is essentially a website that gives you fractions of a Bitcoin in exchange for performing simple tasks like watching an ad.

Another option is to participate in so-called “cryptocurrency bounty programs”, where you can earn Bitcoin and other cryptocurrencies by performing simple social media and content creation tasks.

Q: Why is Bitcoin cheaper on some platforms?

Bitcoin prices vary depending on the exchange they’re trading on.

The varying prices come down to a few things.

First, liquidity. Bitcoin trading volume can be massive on the larger exchanges, such as the ones above, but much lower on smaller exchanges. Those differences in supply affect the price.

Second, there’s no established common way to price bitcoin, which means nobody knows what it’s “supposed” to cost, and the price is based purely on trading.

Third, moving money across exchanges can be messy and inefficient, and requires lots of collateral to do efficiently. That means it’s hard for traders to arbitrage differences across exchanges, which allows these price differences to persist for longer than they would in a more efficient market.

Finally, Pisani says there’s an “infrastructure issue” wherein buyers can’t currently quickly buy bitcoin across multiple exchanges at once, again, making it hard to arbitrage these price differences. Pisani says this will be something that needs to be looked into during the next year as bitcoin increases in popularity.

Conclusion

If you google the words, “buy Bitcoin lowest fees”, you get thousands of results. Most of the sites claiming to have the lowest Bitcoin fees are lying! The truth is that buying Bitcoin is quite expensive.

So, don’t worry too much about the cheapest way to buy Bitcoin. Try to find the best place to buy Bitcoin for you. The first place you buy Bitcoin should be safe and easy to use. Coinbase is both of these things and it’s cheap. That’s why so many people recommend Coinbase to newbies.

Some buyers might care more about privacy than fees. For these people, I would suggest using a peer-to-peer exchange like LocalBitcoins. Or, if you want to avoid the hassle, altogether, you could just purchase BTC via Simplex, with a credit card. They’re also a great way to get involved in the world of crypto. Remember, Bitcoin is more than just money. Bitcoin is a new way for people to connect with each other.

Also, don’t forget to choose a secure wallet for your Bitcoin. Ledger Nano X and Trezor Model T are among the most recommended options.