Futures Trading: An Inside Look at the Most Powerful Crypto Futures Trading Bot

Back in October 2017, Bitcoin really started to shine in the mainstream financial world when the CME Group, which is at the forefront of the derivatives market, rolled out the option to trade in Bitcoin futures.

Fast forward to four years later, and ProShares stepped up to the plate, launching the very first Bitcoin ETF based on those futures contracts. This was a big deal— it was the first time a crypto ETF got the thumbs up for trading on a major U.S. exchange.

Thinking about diving into crypto futures too? We don’t blame you — they’re a pretty cool way to play the crypto market game and give your crypto portfolio a bit of a safety net.

But, before you jump in, let us walk you through how they tick and what to watch out for.

Table of Contents

What Is Future Trading in Crypto?

A crypto futures contract is basically a promise to buy or sell a digital asset at a predetermined price at a specific point in the future. It’s a nifty tool that traders and investors use to shield themselves from the wild swings in asset prices that could happen down the line. Besides offering a hedge against fluctuating prices, futures are a playground for those looking to make a buck through speculation or arbitrage.

In the nuts and bolts of a futures contract, you’ll find several important details laid out, such as the asset in question, how big the contract is, how it’ll settle (either with the actual asset changing hands or just cash), price and position limits, the total value of the contract based on current prices, and the smallest price change it can make, known as a ‘tick’. Each futures contract has an expiration date, and managing this end date is a crucial part of a futures trader’s strategy.

There are three main strategies when it comes to the expiration of futures:

- The most popular strategy is to close out the position before the contract expires. This is done by making an opposing trade of the same size, effectively cancelling out the original position.

- If a trader wants to keep their position beyond the expiration date, they can ‘roll it over’ by closing the current contract and opening a new one for a future month.

- If a trader doesn’t offset or roll over their position, the contract will go to settlement, and if they’re short, they’ll have to deliver the asset as per the contract’s terms.

But here’s an interesting twist: most crypto futures on exchanges these days are ‘perpetual’, meaning they don’t have an expiration date. These perpetual futures are all about betting whether the price will go up or down from where it is right now. On regulated exchanges like the Chicago Board Options Exchange (Cboe), however, they keep it old-school with traditional dated futures contracts.

Crypto Future Trading Example

So, with a regular old futures contract, you’re agreeing to buy or sell your bitcoin at a set price in the future, say $50,000 in six months. But the actual price of bitcoin right now, known as the “spot price,” can be different. This difference can make the value of your futures contract bob up and down, which is super appealing for folks who like to speculate. As the expiration date of a futures contract approaches, the futures price usually moves closer to the spot price, ensuring the two prices don’t stray too far from each other.

Now, when it comes to perpetual contracts, they too have a set value like traditional futures, but they don’t have an expiration date. This means traders can hold onto a perpetual contract for as long as they want. But to keep the party fair, there’s got to be a way to make sure the price of the perpetual contract doesn’t drift too far away from the actual market price of Bitcoin. And here’s where it gets clever: perpetual contracts use a neat trick called the “funding rate” to stay close to the spot price. This way, traders can keep on trading, riding the waves of market prices without ever having to worry about a closing bell. Unless, of course, they face liquidation, but that’s a whole different ball game.

What Is Liquidation in Crypto Futures?

Alright, so when you hear “liquidation,” you might think it’s about turning investments into cash—which usually sounds like a good thing. But when we’re talking about futures trading, liquidation is more like a storm cloud you want to steer clear of.

Here’s the deal: if you’re trading with leverage, it’s like the exchange is spotting you some extra cash to boost your buying power. But the exchange isn’t just being generous; they’re also covering their own backs. They set a limit to how much they’ll let you lose before they step in. Because let’s face it, the futures market can be a wild ride, with prices that can jump or plummet suddenly, risking more than you have.

If your losses dip below a certain point—called the maintenance margin—the exchange won’t just tap you on the shoulder; they’ll shut down your trade to prevent further damage. Unfortunately, this often means your invested capital says “bye-bye” and you’re left with empty pockets.

How quickly this happens depends on how bold you were with your leverage. If you were cautious and used less leverage, you’ll have more wiggle room, and small market dips won’t knock you out so fast. But if you went big and used a lot of leverage, your liquidation point is much closer. A sharp move in the market could mean you hit the red zone and face hefty losses in the blink of an eye. So, the less leverage you use, the more breathing space you have before facing a potential liquidation.

What Is a Future Trading Platform in Crypto?

A futures trading platform in the crypto world is essentially an online marketplace where traders can dive into the future prices of cryptocurrencies.

Here’s how it works: these platforms offer what’s known as futures contracts. These contracts are agreements to buy or sell a particular amount of a cryptocurrency at a predetermined price at a specified time in the future. The beauty of it is you don’t have to own the actual cryptocurrency right now. You’re just locking in a price for a future transaction.

What Is the Best Future Trading Strategy in Crypto?

Crypto futures trading is now available across a wide array of leading exchanges, including Binance, Gate.io, KuCoin, Bybit, among others. You can trade crypto futures on each of those individually, or you can connect your exchange accounts to a third-party cryptocurrency aggregator such as Bitsgap and manage all your trades under one roof — convenience at it’s finest. Currently, Bitsgap offers connections to the spot markets of over 15 different exchanges. When it comes to futures, Binance Futures is the sole option available through Bitsgap for now. But hold tight, because there’s more on the way! OKX futures integration is just around the corner, and for those eager for a KuCoin futures bot, it’s in the pipeline and should be arriving soon. So hop on board with Bitsgap today, give demo futures trading a whirl to get the hang of it, and stay tuned for the addition of more exchanges coming your way.

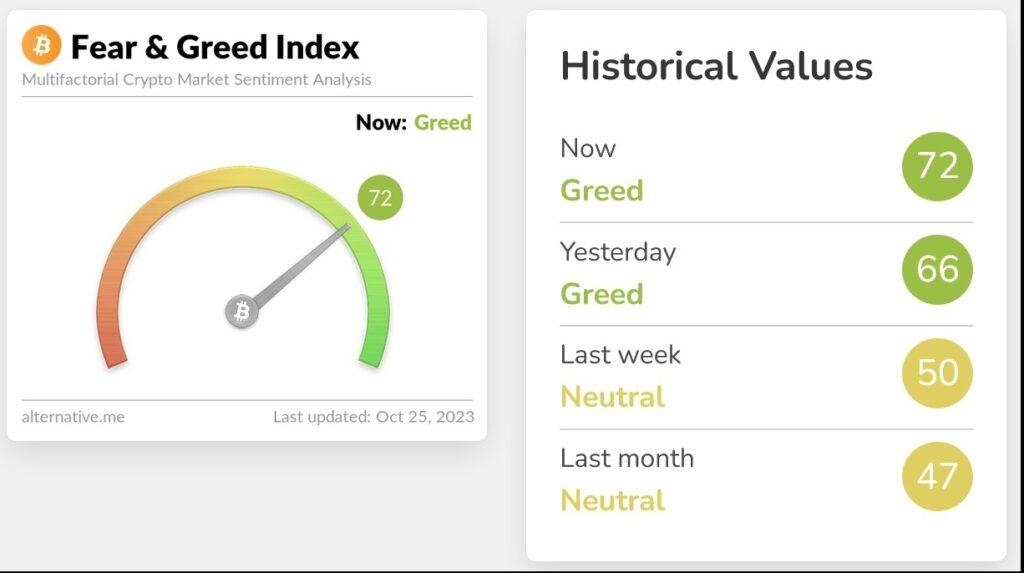

Crypto market sentiment at highest point since BTC’s $69K all-time high

The Crypto Fear & Greed Index has returned to levels not seen since the peak crypto market rally of November 2021.

Bitcoin market sentiment has returned to levels not seen since its price reached $69,000 in mid-November 2021, according to the Crypto Fear & Greed Index.

The index is now at 72 out of a total possible score of 100, placing it within the “greed” ranking — a six-point increase from Oct. 24 and a 16-point bounce from its 50-point “neutral” rank on Oct. 18.

The strengthening market sentiment follows a wave of excitement that BlackRock’s spot Bitcoin exchange-traded fund (ETF) could be inching toward approval by the United States Securities and Exchange Commission.

On Oct. 24, Bitcoin staged its largest single-day rally in over a year, recording a 14% daily gain as its price briefly moved above the $35,000 mark.

The index gathers and weighs data from six market key performance indicators — volatility (25%), market momentum and volume (25%), social media (15%), surveys (15%), Bitcoin’s dominance (10%) and trends (10%) — to score market sentiment each day.

Nov. 14, 2021, was the last time the index reached a score of 72, just four days after BTC notched its all-time high of $69,044 on Nov. 10, 2021, according to CoinGecko data.

The index recorded its lowest-ever score of 7 on June 16, 2022, after the collapse of Do Kwon’s Terra ecosystem.

The fallout from the Terra collapse triggered a cascade of price-dampening effects, which later claimed hedge fund Three Arrows Capital and crypto lender Voyager Digital as casualties, among others.

Following the wave of excitement for spot ETFs, crypto investment firm Galaxy Digital has predicted that the price of Bitcoin could increase by more than 74% in the first year following a successful approval.

Source: https://cointelegraph.com/news/crypto-sentiment-high-point-btc-record-high

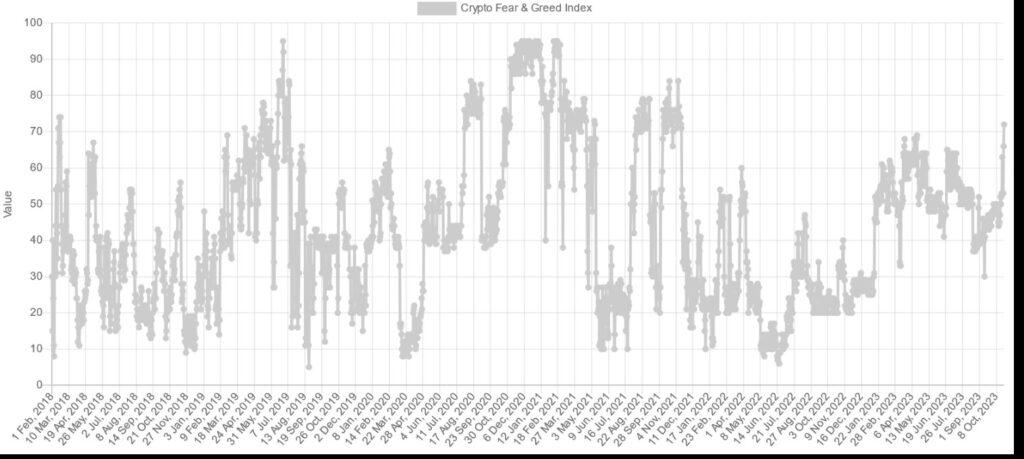

85% of crypto rug pulls in Q3 didn’t report audits: Hacken

A cryptocurrency rug pull is one of the simplest scams to prevent, according to blockchain security auditor Hacken

Cryptocurrency rug pulls are not too difficult to spot by investors, as the majority of such scams usually share distinct and visible features, according to a new report.

Blockchain security auditor Hacken released its latest security insights report on Oct. 25, aiming to spot the trends in Q3 crypto hacks and evaluate how affected projects approached security.

The report paid specific attention to rug pulls, which are a type of exit scam occurring when a team pumps their project’s token before the sudden withdrawal of liquidity. According to Hacken, crypto rug pulls made up the largest amount of exploits in crypto, accounting for more than 65% of all hacks in Q3 2023.

The reason there are so many rug pulls on the market is that it’s easy to create such schemes. “Serial scammers use token factories that exhibit the same behavior to produce fraudulent tokens on a mass scale,” the report notes.

Despite their high prevalence, cryptocurrency rug pulls are “one of the simplest scams to prevent,” Hacken said, providing some tips about such scams based on its Q3 observations.

One of the most crucial ways to assess a project is to check for an independent third-party audit, according to Hacken. Of the 78 Q3 rug pulls examined by Hacken, only 12 reported having completed “any kind of audit.”

But even when a crypto project provides an audit, users should be vigilant to properly check them, as an audit alone doesn’t always guarantee protection from scams, Hacken noted, stating:

“The project can undergo an audit and have an audit report, but with a poor score. Yet, users overlook this and consider the mere fact that the project was audited as sufficient.”

According to Hacken co-founder and CEO Dyma Budorin, investors often ignore red flags like the absence of audits and other issues due to factors like the fear of missing out (FOMO). The industry has seen success stories with memecoins such as Pepe and Shiba Inu, where $100 out of curiosity led to significant profits, so people tend to hope for this history to repeat, the executive noted.

“This desire for substantial returns in a short timeframe often causes individuals to overlook red flags and impulsively dive into investments,” Budorin said, adding:

“Scammers are well aware of this, and they are very good at mimicking successful projects. […] Scammers frequently refer to thriving projects, intensifying the FOMO on the next big opportunity.”

Hacken’s CEO also stressed that the process of investing in cryptocurrency is a “no-brainer for many users,” requiring “only a few clicks.” According to the executive, this fact can also lead to impulsive decision-making.

Source: https://cointelegraph.com/news/rug-pulls-audits-report-hacken

Telegram trading bot Maestro refunds users 610 ETH after router exploit

Maestrobots, a group of crypto bots on Telegram, has refunded users 610 ETH in the aftermath of a 280 ETH smart contract exploit on Oct. 24.

Maestrobots, a group of cryptocurrency bots on the Telegram messenger app, is refunding users in the aftermath of a 280 Ether attack.

The Maestro team refunded the users affected by the Maestro Router 2 contract, the platform announced on X (formerly Twitter) on Oct. 25. According to the announcement, Maestrobots paid a total of 610 ETH in its own revenue to cover all the user losses, worth more than $1 million at the time of writing.

“Every wallet that lost tokens in the router exploit has now received the full amount they lost. Some of you ended up with even bigger bags,” Maestro wrote.

The Maestro team noted that some amounts were paid back in affected tokens and ETH. For nine out of the 11 exploited tokens, Maestro chose to buy and refund tokens instead of sending ETH because “it’s the most equitable and complete refund” it could offer. “We spent 276 ETH to secure our users’ tokens,” Maestro added.

Affected users of the other two exploited tokens — including JOE and LMI — were refunded in ETH, Maestro said, citing a lack of liquidity to buy back the lost tokens. The announcement added:

“So we compensated affected users with the ETH equivalent of their tokens, and boosted that amount by 20% because you deserve it. These refunds cost 334 ETH.”

Blockchain security firm CertiK confirmed to Cointelegraph that it has been able to detect the transactions showing the 334 ETH compensation paid out to users from Maestro.

The refunds came shortly after Maestro reported that the MaestroRouter on ETH mainnet was compromised on Oct. 24, allowing hackers to siphon around 280 ETH in exploited tokens, worth around $485,000 at the time of the hack. The Maestro team said it identified the attack within 30 minutes after the start and fully removed the exploit. The platform also quickly resumed trading, temporarily halting tokens with pools on SushiSwap, ShibaSwap and ETH PancakeSwap.

“Wallets were not compromised at all during this attack. This was purely directed at the Router,” Maestro wrote.

According to the executive summary by CertiK, Maestro’s smart contract breach affected a total of 106 user addresses. The affected tokens included MOG, LMI, JOE, BANANA, OGGY, JIM, ETF, LP, APU, Real Smurf Cat and PROPHET.

“Most of these tokens pumped back up due to the anticipation that we were gonna market buy the tokens. Most of these tokens are still alive and kicking,” a spokesperson for Maestrobots told Cointelegraph.

Maestro, also known as MaestroBots on X, is a Telegram bot facilitating trades across three networks, including Ethereum, BNB Chain and Arbitrum, with a default transaction fee of 1%. The Maestro bot system features three different bots, including the Maestro Whale Bot, the Maestro Sniper Bot and the Maestro Wallet Bot. The Maestro Bots Hub Telegram channel has more than 100,000 subscribers at the time of writing, while its X account counts more than 24,000 followers.

Source: https://cointelegraph.com/news/telegram-maestro-bot-610-ether-refund

Bank of Spain embraces ‘digital euro,’ explains its benefits

The digital euro will make electronic payments a vital piece of the financial system, the statement claims.

Banco de España, Spain’s central bank, has joined a chorus of European banking institutions preparing their customers for the potential benefits of a digital euro. The central bank published a short text on Oct. 19 explaining the nature and uses of the European Union’s potential central bank digital currency (CBDC).

The bank claims that the physical cash format “does not allow to exploit all the advantages offered by the growing digitalization of the economy and society.” However, the digital euro will make electronic payments a vital piece of the financial system.

The authors highlight the possibility of offline payments with the digital euro, emphasizing its level of privacy, equivalent to cash. They also make reservations that in the online form, users’ data would still be visible only to their financial institutions and not to the CBDC infrastructure provider, Eurosystem.

According to the project calendar published in the text, the current “preparation phase,” launched on Oct. 18, will finish by 2025. However, a final decision on issuing a pan-EU CBDC is yet to be made.

The Bank of Finland recently expressed the same amicable sentiment toward the digital euro. A board member, Tuomas Välimäki, called it “the most topical project” in the European payment sector.

On Oct. 25, the European Central Bank (ECB) shared a link to the landing page dedicated to basic information about the digital euro. It promises to deliver an “easier life” and a “stronger Europe.”

Earlier in October, the governing council of the ECB announced the beginning of the ”preparation phase” for the digital euro project. It will last two years and focus on finalizing rules for the digital currency and selecting possible issuers.

Source: https://cointelegraph.com/news/bank-of-spain-embraces-digital-euro-explains-benefits

Binance Blockchain Week announces impressive speaker lineup for November conference in Istanbul

Following the successes in Dubai and Paris, Binance is hosting its third flagship conference in Istanbul by bringing together thought leaders and innovators from a wide range of industries including finance, sports, gaming, Web3, and more.

Istanbul, Turkey – October 5, 2023 – The global blockchain ecosystem behind the largest cryptocurrency exchange by trading volume, Binance, today announced the first wave of speakers for its annual flagship conference Binance Blockchain Week in Istanbul from November 8 to 9, 2023.

Rachel Conlan, Chief Marketing Officer at Binance, shared:

“We are very excited and are looking forward to welcoming the global crypto community to the beautiful city of Istanbul. This is the place to be for blockchain and crypto enthusiasts. In recent years, Turkey has emerged as a promising crypto hub within the region and globally. Turkey stands out as a country with one of the highest crypto adoption rates globally, at around 12 percent now. There’s also a vibrant and inclusive crypto community and startup culture in the country, where the future of blockchain is welcomed with open arms. This makes Turkey the perfect place to learn more about blockchain, share best practices, and chart the new era of finance together.”

With the theme of “The Next Billion: Empowering the Future of Web3,” Binance Blockchain Week Istanbul will focus on the future of Web3, including how blockchain and crypto can empower the next billion people to improve their everyday lives.

The lineup of speakers features innovators, policymakers and industry thought leaders, business influencers, entrepreneurs, including Yat Siu, Chairman and Co-Founder of Animoca Brands; Faruk Eczacıbaşı, President of Turkish Informatics Foundation; Alexandre Dreyfus, Founder and CEO of Chiliz; Sebastien Borget, COO and Co-Founder of The Sandbox; Pär Helgosson, Head of Web3 and Metaverse at Paris Saint-Germain; Eowyn Chen, CEO of Trust Wallet; Shane O’Connor, Innovation Manager for Emerging Tech at UNICEF; and many more. Attendees will also have the opportunity to hear directly from Binance’s senior leadership team including its Head of Regional Markets Richard Teng and Chief Marketing Officer Rachel Conlan.

Rachel added:

“We’re always focused on helping the industry to continue building and maturing in collaboration with other industry players, and conferences like this are pivotal to making that possible.”

This conference aims to provide a platform for people to engage in valuable conversations around Web3 and the latest industry innovations, trends and issues — evoking ideas, facilitating development, making connections, and finding solutions to challenges. Turkey, where traditional finance embraces the future of blockchain, becomes the backdrop.

Thousands of individuals and many notable organizations from all over the globe are expected to join Binance in Istanbul, Turkey this year. Over the coming weeks, Binance will be unveiling more details including influential speakers to catch as well as the full conference agenda through its official channels and event landing page.

Tickets are on sale now, with early bird specials available for a limited period of time.

The upcoming conference in Istanbul follows the incredible successes of Binance Blockchain Week in Dubai and Paris last year. Follow Binance for more information and updates on the conference. For sponsorship and partnership opportunities, please reach out to the events team at [email protected].

Ledger hardware wallet rolls out cloud-based private key recovery tool

Ledger emphasized that the ID checks required for its private key recovery tool are not like KYC checks as they require “much less” information

Hardware wallet firm Ledger is rolling out its cloud-based private key recovery solution despite facing significant criticism from the crypto community.

Ledger Recover, an ID-based private key recovery service for the Ledger hardware wallet, is launching on Oct. 24, the firm officially announced on X (formerly Twitter). The release comes in conjunction with Ledger finalizing the open-source code for the Ledger Recover on GitHub.

Provided by blockchain protection platform Coincover, Ledger’s seed phrase recovery solution is a paid subscription service allowing users to back up their Secret Recovery Phrase (SRP). SRP is a unique list of 24 words that backs up the private keys and gives users access to their crypto assets.

A spokesperson for Ledger told Cointelegraph that a Ledger wallet encrypts a “string of random 1s and 0s” from which a SRP is computed. The encrypted string of numbers is then fragmented into three pieces used to backup a SRP.

“Ledger Recover only interacts with the fragments, and never with your SRP in its readable format,” the representative noted. According to Ledger, encrypted SRP fragments are distributed using end-to-end encrypted and authenticated channels of three independent companies including Ledger, Coincover and EscrowTech. The spokesperson added:

“Each fragment on its own is a useless set of random numbers, and no single company has access to the entire backup. This ensures the highest level of security and removes a single point of failure.”

Ledger Recover was designed for users who “want to add an enhanced layer of resilience” in case their SRP is ever lost or destroyed, Ledger’s chief technology officer Charles Guillemet said. He also emphasized that Ledger Recover is an optional recovery service, adding:

“If you don’t wish to use the service, no worries — it’ll always be 100% optional. You can simply continue using your Ledger as you did previously — nothing will change.”

At launch, Ledger Recover is compatible with Ledger Nano X, with Ledger Stax and Ledger Nano S Plus integration coming in the near future. The solution is not compatible with Ledger Nano S, according to the Ledger Recover FAQ.

Ledger Recover is initially available to passport or identity card holders in the United States, Canada, the United Kingdom and the European Union. “We will be covering more countries and adding support for more documents,” Ledger said.

The firm emphasized that Ledger Recover’s identity verification “is not the same” as Know Your Customer (KYC) checks carried out by centralized crypto exchanges. Ledger noted that its recovery system only requires a “valid, government-issued document,” stating:

“Identity verification inherently collects much less information compared to KYC […] KYC involves ID verification but it can also include revenue information, record of criminal activity, citizenship check, etc.”

According to social media posts, the Ledger Recovery service will be available at $9.99 per month, or about $120 per year. If a user fails to pay the subscription, the subscription will be suspended, allowing the user to reactivate the subscription in the next nine months.

“You will need to pay an administration fee of 50 EUR along with any outstanding balance,” Ledger Recover FAQ reads.

The rollout comes months after Ledger paused the recovery service in May 2023 in response to community backlash. Ledger CEO Pascal Gauthier subsequently said that the firm will launch the product once its open-source code is released.

Ledger’s largest competitor, Trezor, has stayed away from introducing a cloud-based private key recovery solution, opting for a physical backup solution. Trezor launched its own physical seed phrase recovery tool, Trezor Keep Metal, in mid-October 2023.

Source: https://cointelegraph.com/news/ledger-cloud-private-key-recovery

Hong Kong FinTech Week 2023 “Fintech Redefined”

Invest Hong Kong (InvestHK) unveiled details of Hong Kong FinTech Week 2023 (HKFW) today, October 18th. The eighth edition of HKFW, themed “Fintech Redefined,” is scheduled to take place from October 30 to November 5. Positioned at the forefront of global fintech innovations, this flagship event aims to shape the future of fintech across various dimensions of financial services and beyond.

Gathering global leaders at the forefront of innovation, technology, and finance

Organized by the Financial Services and the Treasury Bureau (FSTB) and InvestHK, and co-organized by the Hong Kong Monetary Authority (HKMA), the Securities and Futures Commission (SFC), and the Insurance Authority (IA), HKFW is poised to attract more than 30,000 attendees and generate over 5 million online views from more than 90 economies.

Over 300 distinguished speakers and 540 exhibitors are expected to participate in the main physical conference, which will be held between November 2 and 3 at the Hong Kong Convention and Exhibition Centre.

This year’s conference will unite global leaders and world-leading fintech innovations to explore the future development of fintech through six key themes:

- Global regulations and focuses, including sustainable and green finance.

- Funding and venture capital, as well as family office investments.

- Exploring the realms of artificial intelligence (AI), Web3, and emerging frontiers.

- Unveiling the latest opportunities within the dynamic Greater Bay Area.

- Hong Kong’s innovation journey.

- Business showcases.

“Hong Kong’s fintech industry is entering a new era, where it is no longer solely about technology but also its real-life application. We are excited to witness this transformation and its impact on the financial ecosystem. The upcoming HKFW 2023, with its theme ‘Fintech Redefined,’ will serve as a remarkable platform to showcase pioneering advancements and opportunities in the industry, demonstrating how the real-life applications of fintech can improve financial inclusion, enhance customer experience, and drive sustainable growth.”

– Mr. Joseph Chan, the Acting Secretary for Financial Services and the Treasury stated.

New models, rules, and value creation

This year’s conference will also feature captivating metaverse experiences, showcasing cutting-edge technologies through immersive and educational engagements. These experiences will demonstrate the possibilities of the metaverse in connecting businesses and promoting Hong Kong culture through virtual games and augmented and virtual reality devices.

Additionally, the cross-boundary Greater Bay Area Day will resume on October 31, presenting ample opportunities and synergies between Hong Kong and Shenzhen. A full day forum will be organized in Shenzhen, followed by a series of concurrent company tours to Mainland tech giants.

The conference will offer dedicated spaces such as the Investor Lounge, Venture Stage, workshops, and events specifically designed for investors. InvestHK is also excited to introduce the Women in Tech Lounge, a unique space with special workshops, panels, and networking events tailored to empower and connect women in the tech industry.

“Hong Kong FinTech Week is the ultimate gathering for anyone eager to explore the frontiers of finance and technology, and witness the deepening collaborations within our thriving ecosystem as well as exciting convergence across diverse industries. Continuously pushing the boundaries of excellence, we are thrilled to have HKFW as an anchor event of VIVA HONG KONG, a remarkable lineup of financial, tech, Web3, and cultural events from the end of October to November, bringing together industry leaders, innovators, and startups from around the world to be part of the dynamic momentum reinforcing Hong Kong’s status as Asia’s World City, financial center, and fintech hub.”

– Dr. Jimmy Chiang, the Acting Director-General of Investment Promotion of InvestHK.

InvestHK will host the much-anticipated grand finale of the Global Scaleup Competition. The event will feature 13 finalists carefully selected by a panel of 50 international judges, including investors who collectively manage over US$54 billion in assets. This event is part of the broader Global Fast Track 2023 program, which aims to foster connections between fintech firms, corporate clients, investors, and industry partners. This year, the program received an overwhelming response, with over 500 applications from 63 economies worldwide, setting a new record.

HKFW will also include a series of fantastic events under VIVA HONG KONG, featuring a diverse range of financial, tech, Web3, and cultural events throughout the city, such as ApeFest Hong Kong, the Global Financial Leaders’ Investment Summit, and the StartmeupHK Festival. More information of VIVA HONG KONG can be found at www.fintechweek.hk/viva-hk.

Selected keynote sessions will be live-streamed via the official HKFW app and YouTube channel, as well as several metaverses including in Mainland China.

Further information can be found at https://www.fintechweek.hk/, or follow via official social media accounts:

- LinkedIn: Hong Kong Fintech Week

- YouTube: https://www.youtube.com/c/HongKongFinTechWeek

Source: https://cointelegraph.com/press-releases/hong-kong-fintech-week-2023-fintech-redefined

Cardano’s first-ever social media app goes live

Cardano Spot unveils its application to bring the whole community to one spot.

On October 18, 2023, Cardano Spot launched Cardano’s first-ever social media application. The emerging social network platform built to empower and connect Cardano enthusiasts is now all set to help native projects.

Cardano Spot has built an advanced platform for onboarding Cardano native projects and their communities. Via the social media app, Web3 users can learn and connect with the Cardano ecosystem, subjects ranging from “Emerging Cardano-based DeFi projects” to topics such as “How To Create Non-Fungible Tokens on Cardano (CNFTs)?” The platform has been developed based on community feedback and direction and now available on iOS and Android devices.

“Decentralised social media is the future of how people engage, connect, and earn rewards through contribution. We are thrilled to have launched the first social network on Cardano with the support from the community. ”

– Sebastian Zilliacus, Co-Founder, Cardano Spot

Why Cardano Spot App?

The Cardano Blockchain hosts thousand ongoing projects and boasts a vibrant community of over 4 million wallets. Cardano Spot is designed to cater to these native projects and their communities, offering the following features:

- Community Hub: Experience a personalised and curated home feed where you can create content, connect with creators, and find like-minded community members.

- News Feed: Stay updated with the latest news and insights from the Cardano Ecosystem. Access educational posts, articles, and video materials to enhance your knowledge and expertise.

- Project Library: Explore and learn about various Cardano projects and stay updated on the latest trends in the Cardano ecosystem. The content-rich library provides detailed project descriptions, whitepapers, explainer videos, and links to assist you in researching a project. It serves as your comprehensive resource for conducting thorough research on Cardano projects.

- Events Calendar: Never miss out on in-person and online crypto events with events calendar. Stay informed about upcoming Cardano-related events such as live streams, meetups, discussions, product launches, and more.

- Market Status: Stay informed about the latest information on token prices, market capitalization, and tokenomics, enabling you to make well-informed decisions in the crypto market.

- Multilingual: Multilingual interfaces make Cardano Spot accessible globally, allowing you to use the app in your native language. In its version 1.0, the Cardano Community app is available in English, Spanish, Chinese, Thai, Vietnamese, Portuguese, Japanese, etc.

The enhanced stack ensures that Cardano Spot operates with faster speed and consistency. The application interface is more sleek and intuitive, with an eye-pleasing dark theme.

Bottomline

Access end-to-end knowledge about everything Cardano at your fingertips.

About Cardano Spot

Cardano Spot is an emerging Web3 social media platform developed with the Cardano community at its core. It is a home for Cardano enthusiasts, where users can stay updated with the ecosystem. They can also grow through insights into the market and connections with the community.

Source: https://cointelegraph.com/press-releases/cardanos-first-ever-social-media-app-goes-live

World Blockchain Summit Dubai: Fostering innovation and revolutionizing the digital space

With new regulatory frameworks for digital assets and issuance of commercial licenses for web3 projects, Dubai is all set to become the blockchain capital in the Middle East region.

Sept 28, 2023: World Blockchain Summit, an event by Trescon, returns to Dubai on 1-2 November 2023 at the Address Dubai Marina, with strategic partners like Dubai AI & Web3 Campus by DIFC, the largest cluster of Artificial Intelligence and Web3 companies in MENA.

The Summit, one of the longest-running global blockchain series, has become an integral platform where top blockchain-leaders, industry veterans, web3 innovators and visionaries converge to debate over the current trends and innovations that are driving the inclusion of blockchain based solutions in key sectors of the global economy.

Dubai, one of the leading financial hubs in the region, is rapidly becoming the global blockchain capital through its progressive regulations, favourable investment climate and expanding digital infrastructure. As per a recent Fintech Global report, Blockchain and Crypto emerged as a dynamic subsector within the UAE’s FinTech landscape, commanding a substantial 42 per cent of the total deals in 2023. With the establishment of Dubai AI & Web3 Campus by DIFC, Virtual Assets Regulatory Authority (VARA) Dubai and the Dubai Blockchain Strategy is attracting global investors and innovators, the opportunity is ripe for the UAE to foster a thriving digital economy.

The Summit is bringing together 2000+ web3 decision makers, 300+ investors and 100+ speakers and also features the regional finale of the Startup World Cup organised by the prestigious US-based venture capital firm Pegasus Ventures, offering the winner an opportunity to pitch at the global finals hosted in San Francisco and a chance to win US$ 1 million in funding.

#WBSDubai features exciting keynote speeches, use-case presentations by leading blockchain visionaries and experts, and captivating panel discussions on core issues that dominate the web3 space today. The focal points of discussions at the summit encompass Web3 regulations, NFTs in music and entertainment, Web3 gaming, privacy in blockchain, tokenomics and more.

Amongst the notable speakers at the event are:

- Charles Hoskinson, CEO & Founder, Input Output Global | Cardano

- Fredrik Gregaard, CEO, Cardano Foundation

- Shogo Ishida, Co-CEO, Middle East & Africa, Emurgo

- Julian Banks, CEO, Univox

- William Bao Bean, Managing Director, Orbit Startups

- Miriam Kiwan, Vice President, MEA, Circle

- Joao Blumel, Metaverse Mind Reading Show

- Hasnae Taleb, Member of The American Chamber of Commerce| Partner & CIO -Ento Capital |TV Personality & Influencer, AmCham Abu Dhabi

- Dr. Sameer Al Ansari, CEO, Ras Al Khaimah, Digital Assets Oasis

Sharath Kumar, Business Director, World Blockchain Summit, said:

“Dubai’s global prominence in innovation and technology is undeniable. By embracing blockchain-based solutions, the UAE’s national economy is set to witness a meteoric ascent. Sharing a common passion for global digital transformation, we at Trescon are committed to supporting the global network of innovators, founders and startups through platforms like the World Blockchain Summit. This summit is poised to become the perfect stage for blockchain pioneers to foster meaningful connections and unveil the next-gen solutions that can redefine the blockchain landscape.”

As the countdown for another exciting edition of the World Blockchain Summit begins, seize the moment and get involved with the event. Book your tickets today before it is too late.

The Dubai edition of the World Blockchain Summit is presented by:

- Lead Sponsor: – Unicoin

- After Party Sponsor: – Legacy Network

- Platinum Sponsor: – Zeebu

- Silver Sponsors: – Qlindo, Core, Sui, Galileo Protocol

- Bronze Sponsors: Innes Global, Sastanaqqam, Yardhub, Mimo

- Pitch Partners: Cryptounity, Umma Life, Gorki

- Association Partner: Arabs in Blockchain

About World Blockchain Summit (WBS)

World Blockchain Summit (WBS) is an event by Trescon that supports the growth of the blockchain, crypto and Web3 ecosystem globally.

WBS is the world’s longest-running blockchain, crypto, and web 3-focused summit series. Since our inception in 2017, we have hosted more than 20 editions in 11 countries as we strived to create the ultimate networking and deal flow platform for the Web3 ecosystem. Each edition brings together global leaders and emerging startups in the space, including investors, developers, IT leaders, entrepreneurs, government authorities, and others.

About Trescon

Trescon is a pioneering force in the global business events and services sector, driving the adoption of emerging technologies while promoting sustainability and inclusive leadership. With a deep understanding of the realities and requirements of the growth markets we operate in – we strive to deliver innovative and high-quality business platforms for our clients.

To book your tickets, visit: https://bit.ly/get-passes-wbs-dxb-pr2

KuCoin breaks 30M users as the exchange celebrates its 6th anniversary

Victorial Seychells — KuCoin, a top five cryptocurrency exchange in the world, is celebrating its 6th Anniversary with a breakthrough achievement of surpassing 30 million users, two momentous milestones of its journey at the same time. This remarkable achievement is a testament to KuCoin’s commitment to excellence and its unwavering dedication to the global crypto community.

Since its inception, KuCoin has been committed to providing a secure and reliable platform for users to trade cryptocurrencies. With its user-friendly interface, advanced trading features, and top-notch security measures, KuCoin has gained immense popularity among cryptocurrency enthusiasts and investors worldwide.

CEO Johnny Lyu, in a heartfelt address encapsulated in his CEO Letter, expressed profound gratitude to users for their continuous support throughout this incredible development. He reaffirmed KuCoin’s unwavering core-value to be the ‘People’s Exchange’, continuing to prioritize user asset safety and security, fostering innovation, and providing unparalleled customer service. Furthermore, KuCoin remains devoted to its mission of facilitating the global free flow of digital value.

He also expressed his excitement about reaching this significant milestone, stating:

“We are thrilled to have reached 30 million users on KuCoin. This achievement is a testament to the hard work and dedication of our team, as well as the trust and support of our valued users. Since the release of the first POR in December 2022, KuCoin has been publishing POR for 10 consecutive months, fulfilling our commitment to users and allowing them to trade at the peace. It is precisely the business philosophy of putting users and security first that has allowed us to grow from 0 to 30 million and gain the trust of users. We remain committed to delivering a top-tier trading experience and look forward to continued growth and success.”

The 6th Anniversary marks a significant occasion for KuCoin. To commemorate this celebration, KuCoin is rolling out “Rising Together: Celebrate 6th Anniversary of KuCoin with Million-Dollar Prize Pool”, giving back to the community that has been integral to its success. More details are shared in their blog.

About KuCoin

Launched in September 2017, KuCoin is a global cryptocurrency exchange with its operational headquarters in Seychelles. As a user-oriented platform with a focus on inclusiveness and community action reach, it offers over 700 digital assets and currently provides spot trading, margin trading, P2P fiat trading, futures trading, staking, and lending to its 30 million users in more than 200 countries and regions. KuCoin is currently one of the top 5 crypto exchanges according to CoinMarketCap. In 2023, KuCoin was named one of the Best Crypto Exchanges by Forbes and recognized as a highly commended global exchange in Finder’s 2023 Global Cryptocurrency Trading Platform Awards. To find out more, visit https://www.kucoin.com

How to Convert Cryptocurrency to Cash

It is always good to enjoy a good amount of cash after trading lucratively on the market. But, have you ever wondered how to convert cryptocurrency to cash? The process is very easy and, in no time, you will be enjoying crypto profits. Some grant USD in return, while some grant EURO and GBP.